The global road and bridge construction industry is a core part of transportation infrastructure, playing a strategic role in economic growth and regional connectivity. In 2025, the global market is valued at about USD 2.67 trillion and is expected to reach USD 3.67 trillion by 2030, with a CAGR of 6.5%. The bridge construction market is projected to grow at 4.2% annually from 2025 to 2033, reaching around USD 175.25 billion by 2033.

The Asia-Pacific region leads global growth, driven by population scale and urbanization. Governments are increasing infrastructure spending, while private capital and major contractors are more actively involved. At the same time, the industry is shifting toward digital, intelligent, and low-carbon construction, with modern technologies and equipment becoming key drivers. This white paper analyzes market trends, regional opportunities, competition, and technology directions to support policy, investment, and industry decisions.

Background and Strategic Importance of the Global Road and Bridge Construction Industry

The global road and bridge construction industry is a key foundation of economic development and urbanization, reflecting transport efficiency and national competitiveness. Driven by urban population growth, infrastructure expansion in emerging markets, and renewal of aging networks in developed countries, the market continues to expand. This chapter outlines the industry’s strategic importance from the perspectives of infrastructure investment, urbanization and transport modernization, technology and digitalization, and policy and international cooperation.

Long-Term Trends in Global Infrastructure Investment

Global infrastructure investment remains a key driver of growth, employment, and connectivity, especially amid urbanization and supply chain restructuring. Transport infrastructure accounts for 30%–40% of total spending, with roads and bridges as the largest share. Since the 2020s, investment has continued to expand, with widening regional gaps and more market-based financing, supporting stable demand for road and bridge construction.

Global Road and Bridge Construction Market Size and Growth Trends

| Global Road and Bridge Construction Market Forecast (2024–2030) | |||

|---|---|---|---|

| Year | Total Road/Street/Bridge Market (USD bn) | Bridge Market (USD bn) | CAGR |

| 2024 | 2,600 | 118.9 | — |

| 2025 | 2,750 | 125.0 | 5.5% |

| 2026 | 2,910 | 132.0 | 5.9% |

| 2028 | 3,230 | 150.0 | 5.8% |

| 2030 | 3,700 | 175.0 | 5.9% |

| Global Infrastructure Investment Scale and Growth | ||||

|---|---|---|---|---|

| Category | 2022 | 2024 | 2030 (Forecast) | CAGR |

| Road/Street/Bridge Construction | USD 1.8T | USD 2.6T | USD 3.7T | ~5.9% |

| Total Transport Infrastructure | ~USD 3.1T | USD 3.5T | ~USD 4.2T | ~5.5% |

| Bridge Construction Market | ~USD 105B | ~USD 119B | 175B+ | ~4.2% |

Linkage Between Public Investment and Economic Growth

Infrastructure investment is widely recognized as a fiscal tool with strong multiplier effects. Studies show that transport investment significantly supports GDP growth, job creation, and productivity, especially during economic downturns.

| Macroeconomic Effects of Transport Infrastructure Investment | ||

|---|---|---|

| Indicator | Typical Range | Description |

| Investment Multiplier | 1.5 – 2.5 | Each USD 1 generates USD 1.5–2.5 in GDP |

| Job Creation | 10,000–18,000 per USD 1B | Including direct and indirect employment |

| Logistics Cost Reduction | 5%–15% | Due to improved transport efficiency |

| Regional Investment Growth | +10%–30% | Near logistics and industrial hubs |

Key mechanisms include:

Short Termconstruction drives labor and material demand;

Medium Termimproved efficiency lowers business costs and boosts industrial clustering;

Long Termregional integration expands labor and capital mobility.

As a result, road and bridge projects are often prioritized in economic stimulus programs.

Investment Structure Differences Between Economies

Infrastructure investment structures vary significantly by development stage, directly affecting project types, scale, and equipment demand.

| Infrastructure Investment Structure by Economy Type | ||

|---|---|---|

| Dimension | Developed Economies | Emerging Economies |

| Focus | Maintenance, expansion, smart upgrades | New highways, network expansion |

| Project Types | Bridge reinforcement, road rehabilitation | New corridors, intercity highways |

| Investment Growth | 2%–4% per year | 6%–9% per year |

| Engineering Features | High standards, tight schedules | Large scale, fast rollout |

| Equipment Demand | High precision, low emissions, smart systems | High capacity, mobile, terrain-adaptive |

Implications: Emerging markets drive most new demand; Mature markets emphasize quality, sustainability, and smart construction; Contractors and equipment suppliers must adopt region-specific solutions. This dual structure of “new-build markets + upgrade markets” is expected to persist over the next decade.

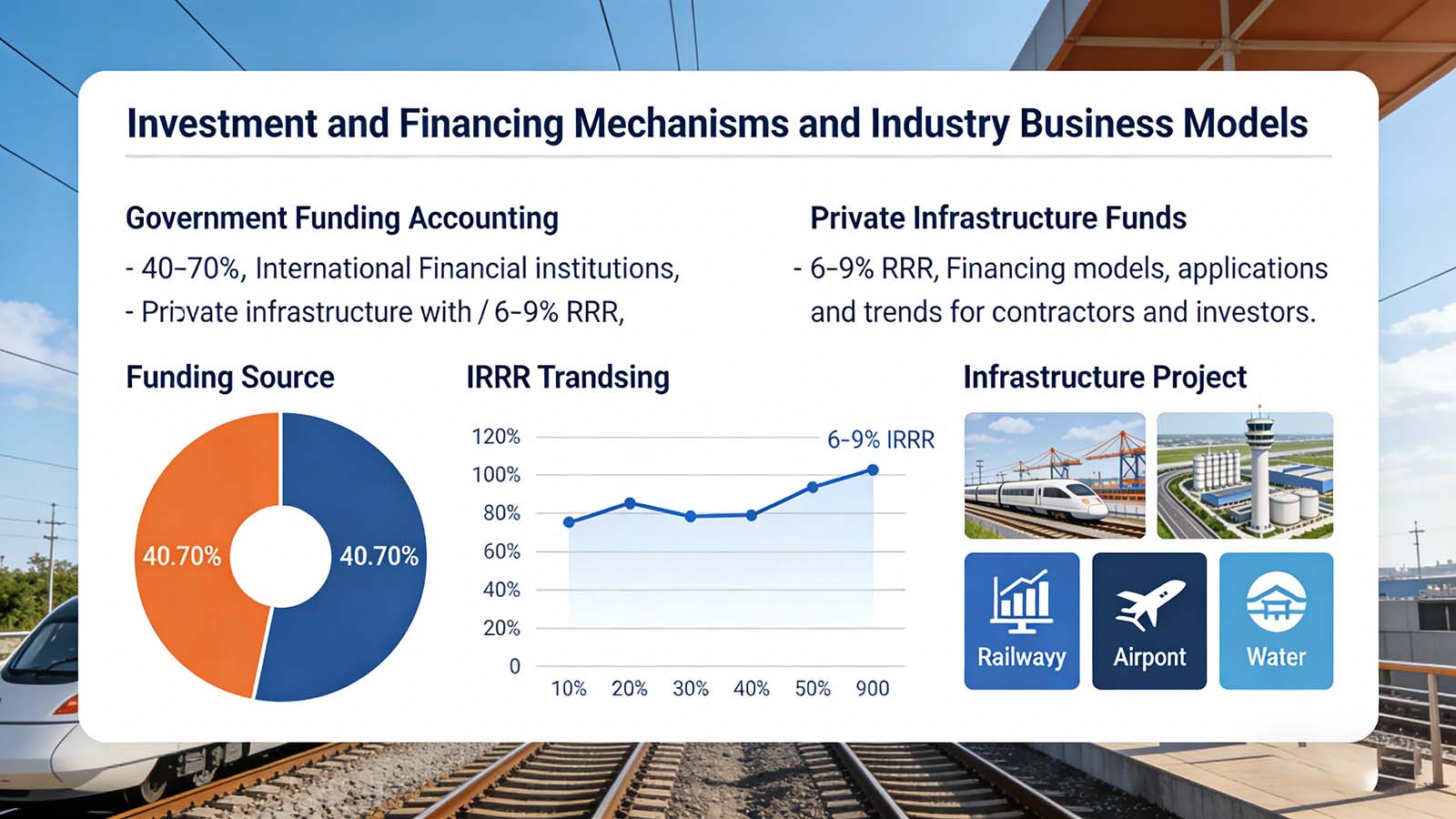

Expansion of Private Capital and Diversified Financing

Traditional government-led investment models are shifting toward diversified financing. PPP, infrastructure funds, development bank financing, and capital market tools are playing larger roles.

| Financing Structure Trends in Road and Bridge Projects | |||

|---|---|---|---|

| Source | 2010s Share | Around 2025 | Key Features |

| Government Budgets | 60%–70% | 45%–55% | Declining due to fiscal pressure |

| PPP Models | 10%–15% | 20%–30% | Risk-sharing, efficiency driven |

| Multilateral Institutions | 8%–12% | 10%–15% | Focus on cross-border projects |

| Funds & Bonds | 5%–10% | 10%–20% | Faster growth in mature markets |

Impacts include: Greater focus on lifecycle returns and sustainability; Contractors need financing coordination and O&M capabilities; Equipment selection emphasizes energy efficiency and reliability. This accelerates the shift from single-project delivery to integrated invest–build–operate models.

Core Role of Road and Bridge Projects in Integrated Transport Systems

In modern transport systems, roads and bridges provide basic network coverage, last-mile access, and cross-regional connectivity. They link railways, ports, airports, and urban transit into one system. Compared with rail and air transport, road networks offer wider coverage and greater flexibility. They remain essential for daily travel, freight movement, and emergency response, and often serve as the first step toward transport modernization in developing and integrating regions.

Road Networks as the Foundation of Regional Connectivity

Road networks determine how easily people, goods, and industries move within and across regions. They form the basic condition for industrial layout and urban development. Many economic geography studies show a strong link between transport accessibility and regional growth.

| Typical Economic Impacts of Improved Road Networks | ||

|---|---|---|

| Impact Area | Quantified Effect | Description |

| Regional GDP Growth | +1.0%–2.5% per year | Within 3–5 years after highway access |

| Manufacturing Investment | +15%–40% | After logistics costs decline |

| Urbanization Rate | +3–8 percentage points | Larger commuting zones, satellite towns |

| Farm Product Circulation | +20%–50% efficiency | Better cold chain and collection routes |

In practice: Industrial parks cluster around highway interchanges. Urban clusters rely on expressways to form “one-hour commuting circles.” Rural and remote areas enter markets mainly through road access. As a result, most national transport plans place road networks ahead of rail and metro systems.

Irreplaceable Role of Bridges in Complex Terrain

In mountains, river networks, coastal zones, and dense cities, bridges often decide whether a transport corridor can exist at all. These projects require higher investment and more advanced engineering than standard roads.

| Importance of Bridges Under Different Terrain Conditions | ||

|---|---|---|

| Terrain Type | Main Constraint | Role of Bridges |

| Mountains & Valleys | Long detours, steep slopes | Create direct routes, cut travel distance |

| Rivers & Wetlands | Ferry dependence, seasonal limits | Enable all-weather crossings |

| Islands & Bays | Blocked logistics and travel | Build regional integration corridors |

| Dense Urban Areas | Limited ground space | Use interchanges and elevated roads |

Key trends include: More long-span bridges each year. More projects with high piers, deep water, and complex geology. Longer construction cycles and stronger reliance on heavy equipment. In Belt and Road corridors, cross-border routes, and coastal city clusters, bridges often act as the critical control points of transport networks.

Coordination with Rail, Ports, and Airports

The goal of integrated transport is smooth transfers between modes. Roads serve as the main platform for collection and distribution in this system and keep multimodal transport running efficiently.

| Functional Coordination Between Transport Modes | ||

|---|---|---|

| Mode | Main Advantage | Dependence on Roads |

| Rail | Bulk cargo, long distance | Stations rely on road access |

| Ports | Global trade hubs | All inland logistics use roads |

| Airports | High-value, time-sensitive cargo | Roads handle last-mile movement |

| Urban Rail | Core city commuting | Suburbs and industry zones rely on roads |

This coordination shapes construction demand: Port access roads and logistics parks grow together. Express roads support high-speed rail hubs and airport zones. More multi-level interchanges and heavy-load corridors appear. Road and bridge construction now forms part of integrated hub development, not just standalone transport projects.

Urbanization and Logistics Upgrades Driving Construction Demand

Global urbanization and logistics modernization are advancing at the same time and together drive sustained growth in road and bridge construction demand. Urban population growth pushes cities to expand roads, expressways, and interchanges. At the same time, rising e-commerce and supply chain restructuring strengthen the role of road transport in short- and mid-distance freight. As a result, road networks must become not only denser, but also faster, stronger, and built to higher standards. This directly increases project scale, technical complexity, and equipment requirements.

Urban Expansion and Demand for Urban Expressway Systems

By 2025, more than 58% of the global population lives in urban areas, with Asia and Africa showing the fastest growth. City expansion puts pressure on existing roads and accelerates the construction of expressways, ring roads, and multi-level traffic systems.

| Impact of Urbanization on Road Construction | ||

|---|---|---|

| Indicator | Trend | Impact on Construction |

| Built-up Urban Area | Continuous expansion | New arterial and connector roads |

| Commuting Distance | Increasing | More expressways and ring roads |

| Congestion Index | Rising | More interchanges and widening projects |

| Land Use Intensity | Higher | More elevated and underground roads |

Engineering changes include: More elevated expressways and complex interchanges; More night work and time-limited construction; Higher demands on paving accuracy and continuous operations. Urbanization is shifting construction from large-scale expansion to high-density and high-efficiency urban building modes.

Rising Dependence on Road Transport from E-commerce and Supply Chains

Rail and waterways remain cost-effective for bulk transport, but roads dominate regional distribution, industrial transfers, and e-commerce logistics. With instant delivery, decentralized production, and multi-node warehousing, road freight demand keeps rising.

| How Logistics Upgrades Drive Road Construction | ||

|---|---|---|

| Logistics Trend | Road System Need | Construction Demand |

| Multi-warehouse networks | More suburban access roads | Dedicated park roads |

| Instant delivery | Higher traffic efficiency | Expressway and interchange upgrades |

| More heavy trucks | Higher pavement load capacity | Thicker pavement and stronger bases |

| All-weather transport | Higher durability | Higher construction standards |

Direct results include: Higher road grades along industrial and logistics corridors; Faster construction of port access roads and airport logistics routes; Stronger demand for soil mixing, asphalt production, continuous paving, and high-compaction equipment.

Faster Development of Industrial Parks and Port Access Corridors

Manufacturing is shifting toward regional and decentralized layouts. New industrial parks and port hubs often build external access roads at the same time as park development. These projects rank high on local government investment lists.

| Table 1-9: Industrial Infrastructure Driving Road Construction | ||

|---|---|---|

| Scenario | Road Function | Engineering Features |

| Manufacturing Parks | Frequent heavy truck traffic | Heavy-duty pavement structures |

| Port Hinterland Routes | High-volume freight collection | Multi-lane express roads |

| Resource Development Zones | Long-distance transport | Mountain and complex geology |

| New Urban Districts | Mixed passenger and freight | Integrated road networks |

Impacts on the construction industry include: Tight project schedules and high construction intensity; Demand for complete equipment sets and continuous operations; Strong pressure to balance speed and quality. These projects often decide local investment attraction and industrial landing speed, so they receive top funding priority.

Global Market Size and Development Trends of Road and Bridge Construction

In the mid to late 2020s, the global road and bridge construction market keeps expanding, driven by urbanization, transport network upgrades, and supply chain changes. New projects grow alongside maintenance of existing roads and bridges. Asia-Pacific delivers most new growth, while North America and Europe focus on upgrades. Projects are getting larger, faster, and built to higher technical standards. This chapter analyzes global and regional market size, investment structure, and medium- to long-term growth, highlighting the industry’s current stage and future drivers.

Global Market Size and Growth Rate

Over the past decade, the global market has grown steadily despite economic cycles, showing infrastructure investment’s long-term and policy-driven nature. Since the 2020s, city clusters, economic corridors, and renewal of aging transport assets have shifted growth from pure expansion to a combined model of new construction, rehabilitation, and smart upgrades. Road and bridge projects still take the largest share of transport infrastructure investment and remain the core sector shaping overall market size.

Total Investment Scale and CAGR

Globally, road and bridge construction has reached a stable trillion-dollar annual investment level and keeps medium-to-high growth in the mid-term. Growth comes from steady fiscal support, transport modernization plans, and regional connectivity programs, which provide long-term funding for the sector.

| Global Road and Bridge Construction Market Size and Growth Range (by Investment) | |||

|---|---|---|---|

| Year | Global Market Size (USD trillion) | Annual Growth Range | Key Background |

| 2020 | 1.9 – 2.1 | — | Project delays during the pandemic |

| 2023 | 2.3 – 2.5 | 5% – 6% | Economic recovery and stimulus |

| 2025 | 2.6 – 2.9 | ~6% | City clusters and logistics corridors |

| 2030 (Forecast) | 3.5 – 3.9 | 5% – 6% | New builds plus asset renewal |

Growth drivers include:

- Policy-led investment: transport remains a top fiscal stimulus tool;

- Rigid urban demand: cities keep expanding roads and expressways;

- Supply chain security: cross-regional logistics corridors gain priority.

Overall, market growth depends more on long-term structural demand than on single economic cycles.

Investment Structure: Roads vs. Bridges

Within transport infrastructure, road projects still take the largest share. However, bridge projects keep gaining weight in unit cost, technical complexity, and capital intensity, especially in urban clusters, river and sea crossings, and mountain expressways.

| Global Investment Structure of Road and Bridge Construction | ||

|---|---|---|

| Project Type | Investment Share | Investment Features |

| Roads and Expressways | 65% – 70% | Long routes, high volume, continuous construction |

| Bridge Projects | 20% – 25% | High unit cost, complex technology |

| Interchanges and Hubs | 5% – 8% | Key urban traffic nodes |

| Auxiliary Works | 3% – 5% | Drainage, protection, traffic facilities |

Structural trends: More long-span bridges and multi-level interchanges; More elevated roads and composite transport structures in cities; Rising capital share of bridge projects in total investment. This trend pushes contractors and equipment suppliers to upgrade toward complex structural engineering capabilities.

New Construction vs. Rehabilitation Markets

As large volumes of transport assets enter mid-to-late service life, rehabilitation and upgrading now drive stable growth, and in developed economies they already exceed new construction.

| Share of New Build vs. Rehabilitation by Region | |||

|---|---|---|---|

| Region | New Build Share | Rehab & Strengthening Share | Market Stage |

| North America | 30% – 40% | 60% – 70% | Asset maintenance dominated |

| Europe | 35% – 45% | 55% – 65% | Safety and green upgrades |

| Asia-Pacific | 60% – 70% | 30% – 40% | Expansion still ongoing |

| Middle East | 70%+ | <30% | New cities and corridors |

| Africa | 75%+ | <25% | Network expansion stage |

Construction impacts: Rehab projects focus on short schedules, low traffic disruption, and precise work; New builds require high-capacity, continuous operations and fast delivery; Equipment must support both mass paving and precision construction. The market is shifting to a dual-engine model of asset renewal and network expansion, rather than relying only on new builds.

Regional Market Size Distribution

As global economic structures shift and infrastructure strategies adjust, the road and bridge construction market shows clear regional differences. Economic development levels, network maturity, policy priorities, and financing models shape both market size and growth patterns. Overall, Asia-Pacific remains the largest growth engine, while North America and Europe focus on renewal and upgrading. The Middle East, Africa, and Latin America show strong potential in new construction, but with higher uncertainty. This section reviews market scale and structure across five major regions.

| Regional Market Size and Growth Comparison | ||||

|---|---|---|---|---|

| Region | 2025 Market Size (USD tn) | 2030 Forecast (USD tn) | CAGR 2025–2030 | Core Growth Drivers |

| Asia-Pacific | 1.05 | 1.38 – 1.60 | 5.8% – 6.3% | Urbanization + New corridors |

| North America | 0.62 | 0.70 – 0.78 | 3.2% – 4.0% | Maintenance + Smart upgrades |

| Europe | 0.51 | 0.55 – 0.62 | 2.5% – 3.5% | Green transition + Safety |

| Middle East & Africa | 0.18 | 0.25 – 0.32 | 7.0% – 9.0% | Network expansion + Financing |

| Latin America | 0.14 | 0.18 – 0.23 | 4.0% – 6.0% | Logistics corridors + Regional links |

Asia-Pacific: The Largest Growth Market

Large populations, rapid urbanization, and strong demand for network expansion keep Asia-Pacific in the lead. China, India, and Southeast Asia continue to invest heavily in highways, inter-regional corridors, and urban expressways.

| Asia-Pacific: The Largest Growth Market Size and Growth | |||

|---|---|---|---|

| Indicator | 2023 | 2025 | 2030 (Forecast) |

| Market size (USD trillion) | 0.92 | 1.05 | 1.38 – 1.60 |

| Share of global market | ~38% | ~39% | ~39% – 41% |

| CAGR | 6.5%+ | 6.2% | 5.8% – 6.3% |

Urban expansion and road capacity upgrades move in parallel.

Regional connectivity corridors drive cross-border projects.

Manufacturing and logistics upgrades require higher-grade road networks.

High concentration of expressways and long-span bridges.

Complex terrain increases engineering difficulty.

Private capital and international financing play a growing role.

North America: Renewal-Dominated Market

North America focuses mainly on maintenance, reinforcement, and smart upgrades. Many roads and bridges built in the mid-to-late 20th century now require major renewal.

| North America: Renewal-Dominated Market Size and Growth | |||

|---|---|---|---|

| Indicator | 2023 | 2025 | 2030 (Forecast) |

| Market size (USD trillion) | 0.58 | 0.62 | 0.70 – 0.78 |

| Share of global market | ~24% | ~23% | ~20% – 21% |

| CAGR | 3.5% | 3.8% | 3.2% – 4.0% |

Many small and scattered bridge repair projects.

ITS upgrades receive strong policy support.

High labor costs push automation and mechanization.

Safety improvement and risk control of aging assets.

Road upgrades linked to urban redevelopment and rail access.

Integration of smart traffic management systems.

Europe: Green and Safety-Oriented Investment

Policy and green transition strongly influence Europe’s market. Governments stress carbon reduction, environmental compliance, and safety, which raises technical standards and project complexity.

| Europe: Green and Safety-Oriented Investment Market Size and Growth | |||

|---|---|---|---|

| Indicator | 2023 | 2025 | 2030 (Forecast) |

| Market size (USD trillion) | 0.48 | 0.51 | 0.55 – 0.62 |

| Share of global market | ~20% | ~19% | ~15% – 16% |

| CAGR | 2.5% | 3.0% | 2.5% – 3.5% |

High share of rehabilitation and safety upgrades.

Strict noise and emission rules promote green construction methods.

Projects often combine with urban renewal and slow-traffic systems.

EU green infrastructure policies and carbon regulations.

High durability and safety standards.

Demand for cross-border freight and urban traffic integration.

Middle East & Africa: New Network Construction

Middle Eastern countries invest in new cities and logistics hubs, while many African countries still work to complete basic national road networks.

| Middle East & Africa: New Network Construction Market Size and Growth | |||

|---|---|---|---|

| Indicator | 2023 | 2025 | 2030 (Forecast) |

| Market size (USD trillion) | 0.16 | 0.18 | 0.25 – 0.32 |

| Share of global market | ~7% | ~7% | ~7% – 8% |

| CAGR | 7.0%+ | 7.5% | 7.0% – 9.0% |

Middle East focuses on hubs and international corridors.

Africa still needs large-scale road network expansion.

Extreme climates raise construction and maintenance costs.

Coastal economic belts and trunk highway systems.

More funding from multilateral banks and PPP models.

Urban growth and industrial park connectivity needs.

Latin America: Regional Connectivity and Logistics Corridors

Fiscal limits, complex terrain, and political volatility slow investment, but demand for cross-border logistics corridors and port access roads remains strong.

| Latin America: Regional Connectivity and Logistics Corridors Market Size and Growth | |||

|---|---|---|---|

| Indicator | 2023 | 2025 | 2030 (Forecast) |

| Market size (USD trillion) | 0.12 | 0.14 | 0.18 – 0.23 |

| Share of global market | ~5% | ~5% | ~4% – 5% |

| CAGR | 4.5% | 5.0% | 4.0% – 6.0% |

Mountains and rainforests raise construction difficulty.

Public budget swings affect project schedules.

Projects rely heavily on development banks and global contractors.

Cross-national highway corridors.

Port-to-hinterland logistics routes.

Industrial and agricultural export channels.

Road and Bridge Construction Industry Outlook for the Next 5–10 Years

As the global economy recovers steadily, while supply chains restructure and climate targets tighten, road and bridge construction is shifting from scale-driven growth to structure-driven upgrading. Over the next 5–10 years, the market will continue to grow at a mid-to-high rate. New demand will mainly come from network expansion in emerging economies, rehabilitation in mature markets, and the rollout of green and smart transport systems. In the long term, three trends will dominate: wider regional gaps, faster investment restructuring, and higher technical entry barriers.

Medium- to Long-Term Global Market Forecast

Supported by population growth, urbanization, and logistics demand, the global road and bridge construction market will expand steadily through 2030, and then move into an upgrade-led stage.

| Global Road & Bridge Construction Market Forecast | ||

|---|---|---|

| Year | Market Size (USD tn) | YoY Growth Range |

| 2025 | 2.6 – 2.8 | 5.5% – 6.5% |

| 2030 | 3.5 – 3.8 | 5.0% – 5.8% |

| 2035 | 4.3 – 4.8 | 4.0% – 5.0% |

Trend interpretation:

- 2025–2030: New builds and upgrades expand at the same time, keeping growth high.

- 2030–2035: Mature markets focus on deep rehabilitation. Growth slows, but project value and technical standards rise.

- The industry shifts from volume-driven to quality-driven growth.

Growth Focus Shifts Further to Asia-Pacific and Africa

Most new global transport investment over the next decade will come from Asia-Pacific and parts of Africa. Regional imbalance will continue to widen.

| Regional Contribution to New Investment (2025–2035) | ||

|---|---|---|

| Region | Share of New Global Investment | Main Sources of Growth |

| Asia-Pacific | 45% – 50% | Highway expansion, cross-regional corridors, urban expressways |

| Middle East & Africa | 15% – 20% | National trunk roads, port access corridors |

| North America | 12% – 15% | Bridge repair and ITS upgrades |

| Europe | 10% – 12% | Green transport retrofits, bridge replacement |

| Latin America | 6% – 8% | Logistics corridors, rural road upgrades |

Structural shifts: Asia-Pacific remains the core market, with rising complexity and stricter environmental standards. African countries enter a peak phase of basic network construction. Developed economies move fully from new builds to safety, durability, and smart upgrades.

Investment Structure Shifts Toward Upgrading and Retrofits

Project mix will change, with rehabilitation and functional upgrades taking a larger share.

| Global Investment Structure Trend | |||

|---|---|---|---|

| Project Type | 2025 | 2030 | 2035 (Forecast) |

| New roads & bridges | 55% | 48% | 42% |

| Rehabilitation & strengthening | 25% | 30% | 35% |

| Smart & green upgrades | 20% | 22% | 23% |

Key directions: Fast growth in bridge monitoring, strengthening, and durability upgrades. Intelligent road systems become a new demand driver. Higher requirements for equipment precision, continuity, and environmental performance.

Technology and Construction Models Reshape the Industry

Technology upgrades will strongly affect competitiveness, and industry concentration is likely to rise.

Key Technology Trends

Industry impact: Large contractors and system solution providers gain stronger advantages. Small and mid-sized firms face pressure from equipment and tech upgrades. Integrated procurement of equipment + methods + digital platforms becomes common.

Direct Impact on Contractors and Equipment Markets

Rising project complexity increases demand for integrated and adaptable equipment systems.

Equipment demand by project stage

Procurement trends:

- Stronger focus on adaptability to complex site conditions.

- Higher expectations for delivery speed and local service support.

- Shorter project cycles drive demand for multi-functional and fast-relocation equipment.

Technology Trends and Equipment Transformation in Global Road & Bridge Construction

As projects grow larger, schedules tighten, and environmental rules become stricter, road and bridge construction is shifting from experience-based work to technology-intensive, equipment-led, and system-integrated delivery models. Digital management, prefabrication, low-carbon processes, and smart equipment now improve efficiency, quality stability, and site safety. At the same time, equipment is evolving from single machines to integrated and intelligent system solutions, reshaping project organization and industry competition.

Digital Construction and Smart Jobsite Systems

With larger and more complex projects, traditional paper-based and experience-driven management can no longer meet today’s needs for schedule control, traceable quality, and measurable safety. Smart jobsite systems integrate BIM, IoT, positioning, video analytics, and cloud platforms to manage progress, resources, equipment, and worker safety in real time. These tools are moving from pilot use to standard practice on major projects and have become essential for reliable project delivery.

Deep Application of BIM and Digital Twins in Construction

BIM has evolved from a design support tool into a core platform for construction planning and schedule control. When linked with real-time sensor data, it forms digital twin systems that enable synchronized virtual-physical management.

| Main Functions and Impacts of BIM and Digital Twins | ||

|---|---|---|

| Application Area | Function | Direct Value |

| Process simulation | Clash detection and path optimization | Rework reduced by 15%–25% |

| Schedule control | 4D simulation and dynamic updates | Schedule shortened by 8%–15% |

| Quantity tracking | Auto take-off and material monitoring | Cost variance within ±3% |

| Structural health | Linked with monitoring sensors | Early risk detection |

On large bridges, complex interchanges, and tunnel clusters, the combination of BIM and sensor monitoring has become essential for safety control and multi-trade coordination.

Smart Equipment and Automated Precision Control

Digitalization now extends into equipment control systems and turns machines into real-time data nodes. Key processes such as paving, compaction, and mixing are shifting toward automated control and closed-loop adjustment.

| Typical Smart Construction Systems and Results | ||

|---|---|---|

| System Type | Technology | Performance Improvement |

| Intelligent compaction | GNSS + sensor feedback | Uniformity improves by 20%+ |

| Auto leveling systems | Dual laser & satellite control | Smoothness improves by 25%–35% |

| Automatic proportioning | Online weighing with feedback | Material waste drops by 5%–10% |

| Fleet coordination | Position and output linkage | Idle time reduced by 15%–25% |

Quality control shifts from post-inspection to real-time process control, which reduces rework and quality disputes.

Equipment Connectivity and Predictive Maintenance

With connected equipment and continuous data collection, contractors can manage fleets across projects and move from reactive repairs to predictive maintenance.

| Management Improvements from Digital Maintenance | ||

|---|---|---|

| Area | Traditional Mode | Digital Mode |

| Fault detection | Manual inspection | Real-time alerts |

| Maintenance method | Breakdown repair | Predictive servicing |

| Spare parts | Experience-based stocking | Lifecycle-based supply |

| Project dispatch | Manual coordination | System-recommended scheduling |

Overall results: Downtime reduced by 20%–40%, Annual maintenance cost reduced by 10%–18%, Cross-project utilization increased by 10%+. These gains are especially important for large contractors working across multiple regions.

Structural Impact on Project Organization

Digital systems do more than support operations. They also reshape project organization:

Observed results: Project delay risk is decreased by 20%–30%. Accident rate reduces 25%–40%. Management staffing decreases about 10%–15%. For future projects with high standards and complex structures, the level of digital construction capability will directly affect whether contractors and equipment suppliers can enter high-end project supply chains.

Development of Prefabricated and Industrialized Construction Technologies

As labor costs rise, safety standards tighten, and urban construction windows keep shrinking, traditional cast-in-place methods can no longer balance speed and quality. Prefabricated and industrialized construction shifts major structural work to factories and follows a “factory production + rapid on-site assembly” model. This approach shortens project cycles and cuts high-risk site work, making it a key direction for bridge projects and selected road structures.

Large-Scale Use of Precast Girders and Deck Systems

Precast beams and deck panels now form mature systems in expressways, urban viaducts, and interchange projects. They fit best in projects with standard spans and repetitive structures.

| Cast-in-Place vs. Prefabricated Bridge Construction | ||

|---|---|---|

| Comparison | Cast-in-Place | Prefabricated |

| On-site construction time | Long | 30%–50% shorter |

| High-altitude work | High | Much lower |

| Quality stability | Affected by environment | Factory-controlled |

| Weather dependence | Strong | Weak |

| Public disturbance | High | Lower |

Typical applications: Urban elevated expressways, Highway interchanges and Small- to mid-span river and overpass bridges.

Modular Bridges and Rapid Construction Methods

Modular bridge systems show clear advantages in disaster recovery, traffic-maintained construction, and temporary access restoration. Factories produce full or segmented modules, while sites focus on fast lifting and connection.

Technical features: Standardized module interfaces, Quick-lock connection system and Minimal wet work on site.

Efficiency comparison: Compared with traditional construction, modular methods shorten single-span construction from weeks or months to just hours or days, reduce traffic closure time by over 70%, and cut workforce demand by about 40%–60%, significantly improving overall project efficiency.

These systems work especially well in emergency repairs and night-time urban construction windows.

Impact on Concrete and Component Manufacturing Systems

Prefabrication raises demands on dimensional accuracy, material consistency, and supply continuity. This drives component plants toward automated and continuous production.

Key upgrades:

- Batching: Automatic weighing with closed-loop control.

- Mixing: High-uniformity forced mixing.

- Molds: Fast changeover and standardized interfaces.

- Curing: Steam or constant-temperature smart curing.

Results: Strength variation drops by 20%–30%; Batch quality becomes more stable; Component turnaround time shortens

Direct Impact on Equipment Configuration and Site Logistics

Prefabrication shifts equipment demand from earthwork-focused machines to lifting, transport, and positioning systems.

New Equipment Requirements under Prefabricated Construction

- Component transport: Heavy-duty flatbed systems.

- Lifting: Large crawler or truck cranes.

- Precise installation: High-accuracy positioning and synchronized control.

- Continuous operation: High-reliability hydraulic systems.

Site logistics must also align plant output with installation pace, requiring tighter scheduling and coordination.

In the coming years, prefabrication will expand further in bridge projects and extend to selected road structures and auxiliary works, with lasting impact on construction methods and equipment systems.

Green and Low-Carbon Construction Processes and Environmental Equipment Upgrades

Driven by global carbon-neutral targets and stricter environmental regulations, road and bridge construction is shifting from efficiency-only approaches to balancing performance with environmental impact and full life-cycle emissions. The construction phase, a major source of carbon emissions, is highly influenced by material choice, processes, and equipment energy efficiency. Green construction has moved from policy guidance to a key factor in project qualification and bidding, driving process innovation and equipment upgrades.

Promotion of Low-Carbon Materials and Energy-Saving Construction Processes

Material-side emission reduction is one of the core pathways for low-carbon transformation in road and bridge construction. By lowering production energy consumption and increasing material recycling rates, projects can achieve source-level emission reductions.

| Comparison of Major Low-Carbon Materials and Processes | ||

|---|---|---|

| Technology / Material | Key Features | Environmental Benefits |

| Warm Mix Asphalt (WMA) | Mixing temperature reduced by 20–40°C | CO₂ emissions reduced by 15%–30% |

| High-RAP Recycled Asphalt | RAP content of 30%–60% | Virgin asphalt consumption reduced by over 20% |

| Recycled Stabilized Base | Reuse of existing pavement materials | Less waste disposal and lower transport emissions |

| Low-Clinker Cement | Reduced clinker ratio | Cement-related CO₂ reduced by 10%–20% |

In Europe, North America, and parts of the Asia-Pacific region, the share of recycled materials in both new construction and maintenance projects continues to rise. In some regions, minimum recycling rates have already become mandatory bidding requirements.

Upgrade Directions for Environmentally Friendly Mixing Plants and Construction Equipment

Construction equipment is a key control point for emissions and pollution during the construction phase. Upgrade priorities focus on four main areas: combustion systems, dust collection, noise control, and energy-efficiency management.

| Key Upgrade Areas for Environmental Construction Equipment | ||

|---|---|---|

| Equipment System | Upgrade Direction | Compliance and Operational Value |

| Combustion System | Low-NOx burners, precise fuel control | Meets NOx emission standards |

| Dust Collection | Pulse-jet cleaning + secondary filtration | Significant reduction in particulate emissions |

| Noise Control | Fully enclosed structures and sound insulation | Suitable for urban night construction |

| Energy Management | Variable-frequency drives and smart start-stop | Energy savings of 8%–15% |

In urban road rehabilitation projects and in areas near airports and ports, environmentally compliant mixing plants and low-noise equipment have become basic entry requirements.

Electrification and New Energy Trends in Construction Equipment

With the rapid development of battery and electric-drive technologies, some construction equipment is shifting toward electric and hybrid power, especially in emission-sensitive areas.

Key Application Scenarios: Urban core construction zones, Tunnels and underground works and Night construction and residential areas.

| Comparison of Electrified Construction Equipment | ||

|---|---|---|

| Indicator | Diesel Equipment | Electric / Hybrid Equipment |

| Exhaust Emissions | Present | Near-zero on site |

| Noise Level | High | Reduced by 30%–50% |

| Operating & Maintenance Cost | Relatively high | Lower over long term |

| Initial Investment | Lower | Higher |

Although upfront investment remains higher, policy incentives and lower operating costs are rapidly improving the economic feasibility of electric equipment in specific construction scenarios.

Carbon Accounting and Green Construction Evaluation Systems

Green construction is expanding from individual technologies to full-process carbon accounting and performance evaluation systems, becoming an integral part of large-scale project management.

Key Management Focus Areas:

Impacts on Project Delivery: Green indicators directly affect bid success rates, Continuous equipment upgrades by contractors are encouraged andFaster large-scale adoption of low-carbon processes.

Integrated Construction Equipment and System Solution Trends

As road and bridge projects become larger, more systematic, and higher-standard, single machines can no longer ensure continuous operation and stable quality. Construction firms are shifting from traditional “single-machine procurement” to “integrated equipment + full-process solutions,” emphasizing capacity matching, process coordination, and system stability. This trend improves efficiency and reduces bottlenecks caused by equipment mismatches.

From Single-Machine Procurement to Integrated System Configuration

Key construction processes now require multiple types of equipment working continuously. Any weak link can limit overall output.

| Comparison: Single-Machine Procurement vs. Integrated System Solutions | ||

|---|---|---|

| Dimension | Single-Machine Procurement | Integrated System Solution |

| Capacity Matching | Prone to bottlenecks | Unified, optimized design |

| Process Continuity | Easily interrupted | Continuous and stable |

| Commissioning Time | Long | Reduced 30%–50% |

| Project Ramp-Up | Slow | Faster to full capacity |

| Quality Stability | Variable | Controlled and stable |

Integrated solutions are particularly effective for continuous-operation projects such as highways, airport runways, and port access roads.

Typical Integrated Equipment Configurations by Construction Stage

Integration applies not only to equipment quantity but also to systematic combinations aligned with construction processes.

| Integrated Equipment Systems for Road & Bridge Construction | ||

|---|---|---|

| Construction Stage | Integrated Equipment Combination | Core Value |

| Subgrade Construction | Stabilized soil mixing plant + Paver + Compaction equipment | Ensures base strength and uniformity |

| Pavement Construction | Asphalt plant + Paver + Intelligent compaction system | Stable pavement structure quality |

| Bridge Construction | Concrete batching plant + Pumping system + Erection equipment | Continuous pouring & safe lifting |

| Maintenance & Repair | Mobile crushing plant + Recycled mixing equipment | Rapid restoration of traffic capacity |

This systematic configuration supports standardized project organization and reduces reliance on individual experience.

System Solutions Redefining the Role of Equipment Suppliers

Clients increasingly focus on overall construction capability, expanding supplier competition beyond product performance to include solution design, process coordination, and service network capabilities.

Upgraded Requirements for Equipment Suppliers

- Solution Design: Customized configuration based on project conditions.

- Process Understanding: Deep involvement in construction workflow planning.

- Delivery Capability: Synchronized delivery and commissioning of integrated equipment.

- Service Network: Localized maintenance and spare parts support.

- Training System: Systematic operation and maintenance training.

This drives road construction equipment suppliers to transform from “manufacturers” into “construction solution providers.”

Impact on Construction Organization and Project Management

Integrated equipment systems significantly reshape project management:

Scheduling now prioritizes system capacity.

Quality control moves forward to batching and measurement systems.

Project progress becomes less sensitive to individual equipment performance.

Risk shifts from multiple equipment uncertainties to system-level controllability.

Impact Metrics

Overall Project Efficiency: increased by 10%–20%.

Quality Variability: reduced by 15%–25%.

Equipment Utilization: increased by over 10%.

Management Complexity: significantly lowered.

For high-standard projects, suppliers with integrated delivery capability and local service networks are more likely to enter the core supply chain of major contractors.

Different Climate and Geological Impacts on Construction Techniques

Global road and bridge projects span diverse environments—from hot, rainy tropics to freeze-thaw regions, soft soil, mountainous rock, and corrosive coastal zones. Climate and geological conditions strongly influence design, construction methods, material choice, and equipment needs. Matching construction technology to these conditions is critical for structural safety, schedule reliability, and life-cycle cost control.

Hot and Rainy Tropical Regions: Focus on Drainage and Durability

In Southeast Asia, South Asia, Latin America, and equatorial Africa, projects face high heat, heavy rain, and high humidity, with annual rainfall often exceeding 2,000–3,000 mm and unstable construction windows. Poor drainage or material durability can cause subgrade failure, early structural damage, and frequent maintenance. Construction priorities should therefore emphasize drainage efficiency, water resistance, and high-temperature stability, rather than only structural strength.

Subgrade Drainage Design Strategies under Heavy Rainfall

Rainwater infiltration is the primary cause of subgrade strength loss. Studies show that a 5%–8% increase in subgrade moisture content can reduce bearing modulus by 30%–50%, significantly shortening pavement life.

| Subgrade Drainage Design Strategies under Heavy Rainfall Common Failure Modes and Countermeasures: | ||

|---|---|---|

| Failure Issue | Engineering Manifestation | Technical Measures |

| Surface water | Pavement infiltration, crack propagation | Increase cross slope ≥2.0%, improve surface drainage |

| Subgrade saturation | Strength reduction, rutting | Install permeable sub-base + longitudinal blind drains |

| Slope erosion | Landslides, collapse | Multi-level interceptor drains + vegetation protection |

Typical drainage structure combinations:

Concrete and Stabilized Soil Durability Control in Hot and Humid Environments

In regions where temperatures remain above 28°C, accelerated hydration can lead to: Plastic shrinkage cracks, Insufficient surface strength and Premature steel corrosion.

Material optimization strategies:

High original moisture content and clay content.

Dynamic adjustment of stabilizer dosage.

Uniform mixing directly affects structural lifespan.

Real-time adjustment of water and stabilizer ratios.

Continuous output ensures material consistency.

Suitable for short rainy-season construction windows.

Asphalt Pavement High-Temperature Stability and Water Damage Control

In tropical urban roads, surface temperatures can reach 60–70°C. Single-focus material designs risk: High-temperature rutting, Aggregate stripping from water damage and Surface layer loosening.

Asphalt mix design focus:

- High-temperature resistance: SBS-modified asphalt, dense skeleton structure.

- Water damage resistance: Improve mineral filler quality and asphalt film thickness.

- Drainage: Open-graded or semi-drainage pavement structure.

Asphalt plant equipment requirements:

Dryer system must handle high-moisture aggregates.

Burner system must maintain stable thermal efficiency.

Finished material silo requires insulation to reduce temperature drop.

Construction Organization and Equipment Adaptation

In countries with pronounced rainy seasons, available construction days are often below 60%–70% of the year. Construction organization must focus on high-efficiency integrated operations.

Organization optimization strategies:

- Reduce process switching: Continuous batching → transport → paving.

- Lower rework rate: Complete drainage and base layers in advance.

- Increase daily output: Night work + rapid curing techniques.

Equipment configuration trends:

- Mobile asphalt batching plants: close to work zones to reduce rainy-season transport risks.

- Integrated pumping systems: shorten concrete exposure time and improve forming quality.

- Modular supply systems: quick assembly/disassembly for multi-location rotation.

In hot and rainy tropical regions, competitiveness in road and bridge construction depends not just on structural strength design, but on comprehensive integration of drainage systems, material durability, and continuous construction capability. Only by coordinating structure, material mix, and equipment configuration can projects achieve dual stability in quality and schedule under high-climate-risk conditions.

Cold and Freeze-Thaw Regions: Frost Resistance and Construction Window Management

In high-latitude and high-altitude areas, road and bridge projects face repeated freeze-thaw cycles. Soil volume changes and material fatigue drive structural durability decline. Studies show that when annual freeze-thaw cycles exceed 30–50 times, typical pavement failure rates rise sharply, and project lifespan may shorten 30%–50% without targeted design and construction measures. Construction priorities in these regions focus on frost heave control, moisture reduction, enhanced material freeze resistance, and maximizing output during limited construction seasons.

Frost Heave Mechanism and Subgrade Failure Pathways

- Core principle: Frost heave arises from water migration + temperature gradients.

- Freezing: Subgrade uplift, tensile stress in layers.

- Thawing: Rapid load-bearing loss, permanent deformation.

- Multiple cycles: Cracks, rutting, and settlement accumulation.

Soil frost-susceptibility:

- Silt: Very high.

- Fine sand: Medium.

- Clay: Medium-high (depends on moisture).

- Gravel: Low.

Frost-Proof Subgrade Design and Material Control

- Core principle: Combine water isolation + replacement + insulation.

- Non-frost-susceptible fill: Block capillary water rise.

- Frost layer: Extend freeze depth below structural layers.

- Drainage layer: Control long-term moisture.

- Insulation layer: Reduce temperature gradient effects.

- Typical layered structure: Surface → Base → Frost Layer (graded gravel / foam concrete) → Original soil.

Material control:

- Moisture: within optimal ±1%.

- Compaction: ≥ 98–100% design value.

- Frost layer thickness: 30–80 cm, based on freeze depth.

Freeze-Resistant Concrete and Asphalt Design

Core principle: Improve pore stability and low-temperature flexibility.

Concrete:

- Air-entraining agent: Microbubbles buffer frost pressure.

- Low water-cement ratio: Reduce free water content.

- Optimized admixtures: Improve pore structure.

- Extended curing: Ensure early strength.

Concrete with 4–6% air content can 1.5–2× increase freeze-thaw resistance.

Asphalt:

Use low-temperature, high-ductility modified asphalt.

Increase fine aggregate for cohesion.

Avoid forced paving and rolling at low temperatures.

Construction Scheduling and Equipment Adaptation

Principle: Maximize daily output, minimize weather-related delays.

Strategies:

Prefabrication to reduce on-site waiting.

Continuous workflow with smart monitoring for rapid correction.

Heated mixing systems, insulated storage, and pipelines.

Modular site setups for phased construction.

Special Techniques for Bridge Foundations on Permafrost

Core principle: Minimize thermal disturbance to maintain permafrost stability.

Methods:

Ventilated pile cooling systems.

Insulation pads under pile caps.

Limit concentrated heat sources during construction.

Insufficient control can reduce bearing capacity by 40%, a critical structural failure mode.

In cold and freeze-thaw regions, success depends on systematically controlling water migration, temperature gradients, and limited construction windows, not just on individual material properties. Coordinated application of frost-proof subgrade systems, freeze-resistant materials, and high-efficiency modular equipment ensures both structural safety and schedule stability under extreme climate conditions.

Soft Soil and High Groundwater Regions: Foundation Reinforcement and Settlement Control Systems

In delta plains, coastal reclamation areas, and river-lake alluvial plains, soft soil and high groundwater often coexist, featuring low bearing capacity, high compressibility, and long consolidation times. Without systematic ground improvement, long-term subgrade settlement can reach 30–100 cm, causing bridge approach bumps, longitudinal pavement cracks, and drainage system failures. Studies show over 60% of early pavement structural defects are directly linked to insufficient ground treatment. Construction priorities in these regions are: rapidly increasing bearing capacity, shortening consolidation cycles, controlling differential settlement, and ensuring long-term operational stability.

Soft Soil Risks and Structural Failure Modes

Soft soil areas present significant engineering challenges due to their low bearing capacity, high compressibility, and slow natural consolidation. The main risks include:

Typical characteristics of soft soils in these regions include:

Moisture content: 40%–90%.

Compression modulus: 1–5 MPa.

Undrained shear strength: 10–25 kPa.

Natural consolidation time: 5–15 years.

Without accelerated ground improvement or artificial consolidation, these conditions can severely impact construction progress and reduce the service life of the infrastructure.

Ground Improvement Techniques and Suitable Conditions

Selection principle: Balance reinforcement effect, construction period, and overall cost.

| Ground Improvement Techniques and Suitable Conditions | |||

|---|---|---|---|

| Technique | Applicable Soil | Main Effect | Construction Time |

| Preloading + Drainage plates | Thick soft clay | Accelerate consolidation | Medium |

| Deep mixing piles | Soft clay / silt | Increase overall strength | Fast |

| CFG piles | Medium-strength soft soil | Bearing + settlement reduction | Fast |

| Dynamic compaction | Fill / mixed soil | Densification | Fast |

| Vacuum preloading | Extremely wet soft soil | Rapid dewatering | Medium |

Practice trends:

- High-grade highways & bridge approaches: composite ground systems (piles + mattress layers).

- Very thick soft soils: vacuum preloading + drainage plates.

- Tight schedules: deep mixing or CFG piles for rapid structure formation.

Drainage and Stability Control in High Groundwater Areas

In regions with high groundwater levels, the primary goal is to reduce pore pressure and prevent shear failure during construction. Key measures include:

- Temporary dewatering wells to lower the groundwater table.

- Longitudinal and transverse blind drains to remove internal water from the subgrade.

- Impermeable isolation layers to prevent lateral seepage.

- Filter layers to prevent fine particle loss and maintain soil stability.

Critical control indicators during construction: Pore pressure increase in the fill should not exceed 20 kPa per week. Layered fill thickness should be maintained at 20–30 cm per layer to avoid overload-induced instability.

Settlement Monitoring and Construction Risk Management

Effective soft soil management relies on monitoring first and adjusting faster than damage occurs. Common monitoring methods include:

- Settlement plates to track consolidation progress.

- Inclinometers to monitor slope stability.

- Piezometers to control overload risk.

- Surface displacement points to detect differential settlement.

Construction control triggers include:

- Settlement rate exceeding 10 mm/day.

- Pore pressure dissipation lower than the design expectation.

- Continuous horizontal displacement of slopes.

When any of these conditions are observed, construction should pause, preloading should be extended, or additional reinforcement measures should be applied.

Equipment Configuration for Efficient Soft Soil Treatment

Efficient treatment of soft soil requires equipment capable of continuous operation, precise borehole formation, and stable material delivery. Recommended configurations:

Synergistic benefits of this equipment setup include: Continuous operation from mixing to pumping to pile formation can increase unit productivity by 20–35%. Automatic batching systems maintain mix deviation within ±1%, significantly reducing strength variability and improving long-term soil performance.

Bridge Approach Special Settlement Control

Critical node: Bridge approaches are prone to differential settlement in soft soils.

Control measures:

Gradual stiffness composite foundation zones.

Lightweight fill (foam concrete, EPS blocks).

Extended preloading with secondary loading phase.

Gradual stiffness design can reduce bridge approach settlement differential by 40%–60%, significantly improving ride comfort and structural safety.

In soft soil and high groundwater areas, foundation treatment must lead design. Only coordinated use of composite foundations, full-process monitoring, and stable equipment ensures settlement control, bearing capacity, and timely project delivery.

Mountainous and Rocky Terrain Regions: Slope Stability and Complex Bridge–Tunnel Interface Construction

Globally, 35%–40% of new highways are in mountainous or hilly regions, characterized by steep terrain, fragmented rock-soil formations, and complex hydrology. Construction involves high-slope excavation, deep foundations, tall bridge piers, and tunnel intersections. Managing slope stability and sequencing is critical to ensure structural safety and construction efficiency.

Major Risks and Failure Mechanisms

| Major Risks and Failure Mechanisms | ||

|---|---|---|

| Risk Type | Trigger Factors | Engineering Consequence |

| Landslide | Heavy rainfall + cut slopes | Overall subgrade displacement |

| Collapse | Rock joint development + vibration | Collapse of construction face |

| Slope erosion | Poor drainage | Subgrade washout |

| Deep deformation | Groundwater seepage | Abnormal pile foundation loading |

High-Risk Conditions: Slope height ≥ 30 m, Rock Quality Designation (RQD) ≤ 50%, and Annual rainfall ≥ 1,500 mm.

Under these conditions, slope instability probability rises exponentially, requiring tiered reinforcement and full-process monitoring.

Slope Stability Control System

Core Goal: Stepwise unloading, multi-layer reinforcement, and rapid waterproofing.

| Slope Stability Control System | ||

|---|---|---|

| Technique | Applicable Scenario | Main Function |

| Rock bolts/anchors | Rock slopes | Provide active anti-slip force |

| Frame beams + shotcrete | Weathered rock slopes | Surface stabilization |

| Anti-slide piles | Deep landslide masses | Block sliding surfaces |

| Geogrid vegetation | Surface erosion prevention | Ecological stabilization |

Typical Combination:

- Mid-to-high slopes: anchors + frame beams + drainage holes + surface sealing.

- Landslide remediation: anti-slide piles + subsurface drainage + counter-fill.

- Studies show multi-level protection can reduce slope failure risk by 60%–80%.

Drainage Systems and Structural Stability

Consensus: ≥80% of landslides are water-related.

- Intercepting ditches are set at the top of slopes to block surface runoff from entering the slope body.

- Slope drainage channels are arranged along the slope surface to rapidly discharge rainfall and reduce erosion.

- Deep drainage holes are used to lower internal pore water pressure and prevent deep-seated sliding.

- Subgrade blind drains are installed within road structures to avoid long-term water accumulation and softening.

Design Principles:

- Drainage must be implemented early and formed simultaneously with slopes.

- Channels should handle rainfall recurrence up to 10–20 years.

- Late drainage installation compromises long-term stability.

Bridge–Tunnel Interface Construction

Challenges:

- Stiffness transitions → stress concentration.

- Limited space → cross-interference of multiple operations.

- Variable foundations → high differential settlement risk.

Mitigation Measures:

- Gradual stiffness transition structures.

- Short-pile + cushion composite foundations.

- Enhanced drainage at roadway interfaces.

Practice shows proper transition design can reduce interface structural defects by ≥50%.

Blasting and Vibration Control

In hard-rock cuttings and tunnel excavation, blasting remains unavoidable, but vibration must be strictly controlled to prevent secondary damage.

Recommended vibration limits are:

- Slope stability: particle velocity should not exceed 5 cm/s.

- Existing structures: particle velocity should not exceed 2 cm/s.

- Sensitive equipment and facilities: particle velocity should be limited to 0.5 cm/s.

Common control techniques include:

- Micro-delay blasting to reduce instantaneous energy release.

- Smooth blasting to protect final excavation surfaces.

- Pre-splitting blasting to isolate vibration and control crack propagation.

Through precision blasting design, excavation efficiency can be maintained while avoiding secondary slope instability.

Mountain Construction Equipment and Organization

Mountain construction requires equipment and organization models that can adapt to narrow, steep, and fragmented work sites.

Equipment configuration should focus on:

- Lightweight crawler drilling rigs capable of operating safely on steep slopes.

- High-lift wet-mix shotcrete systems for rapid and continuous slope support.

- Long-distance pumping systems to deliver concrete and grout across complex terrain.

- Mountain-specific launching gantries for bridge girder erection in confined valleys.

Construction organization should emphasize:

- Strict implementation of rainy-season work restrictions to reduce geotechnical risk.

- Use of advanced geological forecasting to detect weak zones ahead of excavation.

- Strong multi-process coordination and scheduling to avoid operational conflicts and idle time.

In mountainous and rocky terrain, road and bridge construction has become a geology-driven system engineering task. Slope stabilization, drainage systems, bridge–tunnel transition structures, and precise blasting must form a complete technical chain. High-mobility equipment and meticulous construction management are essential to achieve safety, quality, and schedule optimization in high-risk environments.

Core Construction Processes and Technical Systems for Road and Bridge Engineering

As project scales grow, structures become more complex, and environmental and quality standards rise, road and bridge construction has shifted from single-process civil works to an integrated system combining materials engineering, equipment, information technology, and construction management. The coupling among subgrade, pavement, and bridge works is now much stronger, requiring higher levels of process continuity, equipment matching, and real-time quality control. This chapter reviews mainstream technologies and equipment trends in four areas: subgrade and base courses, pavement structures, bridge superstructures, and digital management systems.

Subgrade and Base Course Construction Technologies

Subgrade and base courses carry traffic loads, control deformation, and ensure pavement durability, making them the most fundamental—and also the most risk-prone—stage in early construction. With higher traffic standards and longer design lives, subgrade construction has moved beyond simple compaction compliance toward systematic control of material performance, structural integrity, and construction processes. Current trends focus on: Composite material stabilization, Continuous construction workflows and Digital quality monitoring.

Application of Stabilized Soil and Recycled Materials

Technical objective: improve bearing capacity while reducing natural aggregate consumption and life-cycle cost.

| Comparison of Stabilization Methods and Engineering Performance | |||

|---|---|---|---|

| Stabilization Method | Strength Increase | Typical Applications | Technical Features |

| Cement-stabilized soil | ↑ 2–4 times | Expressway base courses | High strength, fast early stability |

| Lime-stabilized soil | ↑ 1.5–3 times | Low-grade and rural roads | Low cost, good construction adaptability |

| Cement–fly ash stabilization | ↑ 2–3 times | Industrial park roads | Better shrinkage crack control |

| Foamed asphalt stabilization | Retains original structure strength | Pavement rehabilitation | Fast construction, environmentally friendly |

| Development Trends in Recycling Technologies | ||

|---|---|---|

| Recycling Method | Resource Saving | Engineering Value |

| Cold recycling | 40%–60% aggregate saving | Reduced hauling and waste disposal |

| Hot recycling | Asphalt reuse rate > 80% | Better surface layer performance recovery |

| Full-depth reclamation | Full reuse of base layers | Structural service life reconstruction |

In urban road rehabilitation projects, recycling technologies can shorten construction periods by 20%–35% and significantly reduce traffic closure duration.

Continuous Mixing and Paving Processes

Technical core: ensure stable material proportions and integrated structural formation.

| Comparison of Construction Organization Modes | |||

|---|---|---|---|

| Construction Method | Output Stability | Joint Risk | Suitability for Large-Scale Works |

| Batch mixing | Medium | High | Moderate |

| Continuous mixing | High | Low | Strong |

| In-situ mixing | High | Very low | Strong |

Continuous construction systems can control material fluctuations within ±1%–2%, significantly improving structural uniformity.

Key Technical Elements of Continuous Construction: Automatic weighing and closed-loop proportion control, Synchronized rhythm of mixing, conveying, and paving and Multi-layer integrated paving capability.

Equipment Configuration and Process Stability

Mixing system: High-precision continuous feeding.

Conveying system: Anti-segregation structural design.

Paving system: Automatic leveling control.

Compaction system: Multi-frequency vibration adjustment.

Properly matched complete equipment sets can increase shift productivity by 25%–40%.

Online Quality Monitoring Technologies

Quality control transformation: from post-construction sampling to full-process dynamic control.

| Key Monitoring Parameters and Methods | ||

|---|---|---|

| Parameter | Monitoring Method | Control Purpose |

| Moisture content | Online moisture sensors | Prevent insufficient strength |

| Compaction degree | Intelligent compaction systems | Ensure structural stability |

| Layer thickness | Laser / radar scanning | Prevent under-thickness |

| Surface smoothness | GNSS trajectory analysis | Improve riding comfort |

Performance of Intelligent Compaction Systems: Compaction uniformity improved by 20%–30%, Rework rate reduced by over 30% and One-time acceptance pass rate significantly increased.

Subgrade and base course construction is shifting from experience-based operations to data-driven construction models. By improving foundational performance through stabilized and recycled materials, ensuring structural integrity through continuous mixing and complete equipment systems, and implementing real-time monitoring for full-process quality control, this integrated technical route has become the mainstream solution for high-standard road projects.

Pavement Structure Construction Systems

Pavement structures directly determine road service performance, durability, and maintenance cycles. With increasing traffic volumes, axle loads, and design service lives, pavement construction has evolved from single-material paving to multi-layer composite systems with function-based layering and performance-oriented design. Modern pavement construction must meet not only structural requirements but also targets for construction efficiency, environmental impact, and life-cycle cost control. This section reviews construction processes, technology upgrades, and equipment systems for asphalt pavements, cement concrete pavements, and composite pavements.

Development of Asphalt Pavement Construction Processes

Thanks to short construction cycles, fast opening to traffic, and good ride comfort, asphalt pavements remain the dominant structure for highways and urban arterial roads. In recent years, asphalt technologies have focused on energy reduction, rutting resistance, rapid maintenance, and drainage safety.

| Key Process Technologies for Development of Asphalt Pavement Construction Processes | ||

|---|---|---|

| Technology Direction | Engineering Effect | Typical Applications |

| Warm Mix Asphalt | 20%–30% energy reduction | Urban expressway rehabilitation |

| Modified Asphalt | Rutting resistance ↑ 40%+ | Highway main lanes |

| Ultra-Thin Wearing Course | Rapid maintenance | Roads requiring short closures |

| Porous Asphalt | Improved wet-weather safety | Rainy and slippery sections |

Construction Equipment and Process Coordination

- High-precision pavers: thickness control within ±5 mm.

- High-frequency vibratory rollers: density improvement of 5%–10%.

- Closed-loop temperature control systems: prevent overheating or rapid cooling.

With continuous operations and coordinated equipment, daily paving output can increase by 30%–50%, while reducing joint weakness and delamination risks.

Advances in Cement Concrete Pavement Technologies

Cement concrete pavements, known for high stiffness, strong load-bearing capacity, and long durability, are widely used on highways, industrial roads, and port heavy-load routes. Recent development focuses on fast construction, crack control, and long-term durability.

| Advanced Construction Technologies in Cement Concrete Pavement | ||

|---|---|---|

| Technology | Engineering Advantage | Typical Applications |

| Slipform Paving | High surface smoothness | Highway main lanes |

| Fast-Setting Concrete | Open to traffic within 24 hours | Urban expressway repairs |

| Fiber-Reinforced Concrete | Improved crack resistance | Industrial parks, airport runways |

| Continuously Reinforced Pavement (CRCP) | Extended service life | High-traffic corridors |

With slipform paving and CRCP, pavement service life can be extended from 15–20 years to 25–30 years, while maintenance costs are reduced by 25%–30%.

Application of Composite Pavement Structures

Composite pavements combine rigid and flexible layers to maximize material advantages through functional layering, achieving a balance between durability, ride comfort, and economic efficiency. They are widely used on highways, urban arterials, and rehabilitation projects.

| Typical Structural Combinations of Composite Pavement Structures | ||

|---|---|---|

| Structure Type | Suitable Conditions | Engineering Advantages |

| Concrete Base + Asphalt Surface | Highways | High stiffness + smooth riding surface |

| Stabilized Base + Double Asphalt Layers | Urban arterials | Cost control + structural continuity |

| Recycled Base + Ultra-Thin Overlay | Road upgrading projects | Energy saving + short construction period |

Quantified Engineering Benefits: Structural service life ↑ 30%–50%, Maintenance cost ↓ 25%+ and Daily construction efficiency ↑ 20%–35% (vs. single-structure pavements).

Bridge Superstructure Construction Technologies

Bridge construction is among the most technically challenging stages in road and bridge engineering, involving high-elevation work, long spans, overwater operations, and complex geology. Modern practices are shifting toward prefabrication, intelligent control, and integration of large-scale equipment, with close coupling between machinery, materials, and construction processes. By systematically applying precast girders, deep-water foundation methods, and heavy lifting equipment, construction periods can be reduced while quality and safety are effectively ensured. This section reviews girder prefabrication and assembly, long-span bridge construction equipment, and technologies for high piers and deep-water foundations.

Girder Prefabrication and Assembly Construction

Technical Objective: Improve construction efficiency and structural consistency while reducing on-site construction risks.

Advantages of Prefabricated Construction

- Construction period: Shortened by 20%–40%.

- Quality consistency: Significantly improved; structural deviation ≤ ±10 mm.

- Safety risk: Clearly reduced; exposure to high-elevation work reduced by 30%–50%.

Key Technical Processes

- Standardized girder-yard flow-line production to improve fabrication accuracy.

- Automatic prestressing and tensioning systems to ensure uniform force distribution in prestressed girders.

- Finished-girder transportation and scheduling systems to optimize logistics and reduce secondary damage.

Typical Applications: Continuous girder bridges on expressways, Urban elevated expressways and Port and railway river-crossing bridges.

Construction Equipment for Long-Span Bridges

Technical Objective: Meet the high-precision construction requirements of suspension bridges, cable-stayed bridges, and long-span continuous girder bridges.

| Main Structural Types and Core Equipment | ||

|---|---|---|

| Bridge Type | Core Construction Equipment | Function Description |

| Suspension bridge | Catwalk systems + cable cranes | Support tower construction and ensure cable tensioning accuracy |

| Cable-stayed bridge | Tower cranes + form travelers (hanging baskets) | Precise installation of stay cables and girder segments |

| Continuous girder bridge | Launching gantry (mobile formwork system) | Safe and continuous casting and erection of girders at height |

Technical Performance and Construction Outcomes: Construction deviation controlled within ±15 mm, Maximum single-span lifting capacity ≥ 500 t, and Construction cycle shortened by 25%–35% compared with traditional cast-in-place methods.

Construction Technologies for High Piers and Deep-Water Foundations

Technical Objective: Ensure construction safety and structural stability under high-pier, deep-water, and soft-soil conditions.

Key Technical Challenges: Safety control for high-elevation operations, Positioning accuracy and stability in underwater construction and Temperature control during large-volume continuous concrete pouring.

| Mainstream Construction Solutions | ||

|---|---|---|

| Process | Core Equipment | Engineering Effect |

| Climbing formwork construction | High-strength climbing formwork systems | Continuous casting of high piers with reduced formwork dismantling |

| Steel casing + bored piles | Drilling rigs + dewatering systems | Ensure underwater pile positioning accuracy and construction safety |

| Large-volume concrete pumping | Pumping systems + delivery pipelines | Continuous pouring to reduce cold joint risks |

Key Construction Management Points

- Real-time monitoring of pile position during underwater piling, with deviation controlled within ±5 cm.

- Integrated wind and temperature monitoring during high-pier construction to ensure proper concrete curing.

- Coordinated scheduling with superstructure construction to shorten overall project duration by 10%–15%.

Intelligent Construction and Digitalized Management

Modern road and bridge construction is shifting from experience-driven practices to data-driven operations. Intelligent construction and digitalized management have become key tools for improving construction efficiency, ensuring structural quality, and reducing life-cycle operating costs. Through the application of BIM, intelligent compaction and paving systems, and real-time data collection and decision-support platforms, full-process visualization, controllability, and optimization of construction can be achieved. It enables highways and bridge projects to reach internationally advanced standards in quality, schedule, and safety management.

Application of BIM in Road and Bridge Engineering

Technical Objective: Improve design accuracy, construction controllability, and multi-disciplinary coordination efficiency.

| BIM Application Levels and Functions | ||

|---|---|---|

| Level | Function | Engineering Effect |

| 3D Visualization | Structural and construction scenario simulation | Detect clashes and interferences in advance; reduce on-site rework by 20% |

| 4D Schedule Control | Process animation linked with construction schedule | Optimize construction sequencing; shorten duration by 10%–15% |

| 5D Cost Management | Quantity take-off and cost calculation | Control budget deviation within ±5% |

| 6D Operation & Maintenance | Life-cycle maintenance planning | Improve maintenance efficiency and extend service life by 10%–15% |

Practical Applications

- BIM + 4D simulation applied to continuous girder bridges on expressways reduced process conflicts by 30%.