As of 2025, the global building construction industry is at a critical stage of transformation and growth. Despite challenges such as labour shortages, cost pressures (global building materials prices rose 8.3% year-on-year in 2024, as detailed in the Royal Institution of Chartered Surveyors (RICS) RICS report) and economic uncertainty, the industry maintains its growth momentum, driven by a combination of technological innovations (penetration rate of technologies such as BIM, IoT, and AI increased by 27% compared to 2020) and sustainable development policies.

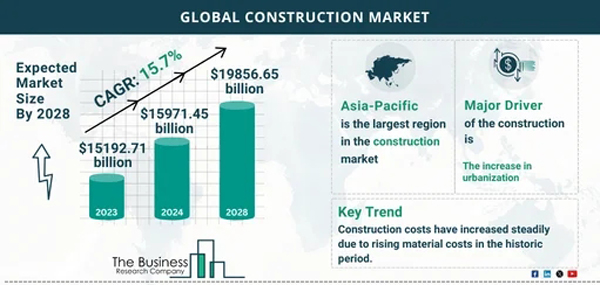

- Market size: The global building construction market reached US$15.97 trillion in 2024 (source: McKinsey Global Institute), and is expected to increase to US$17.05 trillion in 2025, with a compound annual growth rate (CAGR) of 6.8%.

- Growth drivers: Infrastructure investment (e.g. the average annual infrastructure investment along the “Belt and Road” is around US$120 billion) and urban renewal policies (the urbanisation rate in Europe and the US is over 80%, and the proportion of renovation demand has risen to 45%) are the core drivers.

- Regional market differentiation: Asia-Pacific (especially China and India) contributes more than 40% of global growth, North America focuses on smart construction and environmental technology, Europe focuses on green transformation, and the Middle East and Africa see a surge in infrastructure demand.

- Competitive landscape reconstruction: international giants (such as Wanxi and China Construction) integrate resources through M&A, small and medium-sized enterprises transform to specialisation and segmentation, and industry concentration continues to rise.

- Risks and opportunities: labour shortage, material cost fluctuations and geopolitics pose challenges, but the “Belt and Road”, urban renewal and new infrastructure policies unleash trillion-dollar market space.

Based on the following research, it is suggested that the relevant industries need to address the challenges through technology standardisation, supply chain localisation and ESG governance upgrades. Investors are advised to pay attention to: low-carbon material research and development (e.g. bio-based concrete); intelligent construction equipment (global tower crane automation penetration rate may reach 35% in 2025); regional policy dividends (Middle East sovereign fund infrastructure investment by 25% annually).

Overview of the Building Construction Industry

At present, the building construction industry is experiencing the dual changes of regional market differentiation and technological innovation: on the one hand, the global regional market presents differentiated development patterns and growth opportunities; on the other hand, technology trends represented by digitalisation and greening are reshaping the industry ecology.

Global Market Analysis

Below, I will reveal the differentiated growth paths and potential opportunities of the construction industry from dimensions such as the market size of the construction industry, the development trends in the next five years, and regional market analysis.

Building Construction Industry Market Size

Historical Size and Growth:

The global building construction market reached US$15.97 trillion in 2024 (source: McKinsey Global Institute), accounting for 18% of global GDP. it is expected to increase to US$17.05 trillion in 2025, with a year-on-year growth rate of 6.8% (CAGR), and a growth rate of 23% from 2020.

Future Scale Forecast:

The industry is expected to grow at a CAGR of about 4.5%-5% from 2025-2030, and the market size will exceed 38 trillion yuan in 2030. Among them, green building, intelligent construction technology applications and other emerging fields are growing at a significant rate, and it is expected that the market size of green building will reach 1.8 trillion yuan in 2030, and the market for intelligent construction technology will reach 1.4 trillion yuan.

Development Trend in the Next Five Years

Digital Transformation and Intelligence

- BIM+IoT+AI deep integration: global BIM technology penetration rate will increase from 35% in 2025 to 60% in 2030 (Deloitte’s forecast), combined with IoT sensors to monitor construction progress in real time and AI algorithms to optimise the construction plan, the project cost will be reduced by 10%-15%, and the duration of the project will be shortened by 20%.)

- Intelligent equipment and robots: drone inspections, 3D printing technology, etc. will reduce labour dependency and lower construction costs by 15%-20%.

Green and Low-Carbon Transformation

- Environmentally friendly materials and energy-saving technologies: The application rate of green building materials such as recycled concrete, solar photovoltaic systems, and hydrogen energy applications will be increased to 40%, and the market size of green building materials in 2030 will reach 1.4 trillion yuan.

- Carbon neutral target: the industry’s carbon emission intensity is planned to drop by 18%, and the proportion of assembled buildings will exceed 30%.

- Bio-based materials: mycelium insulation panels, bamboo fibre composites market size of 25% annual growth, the EU will legislate to require that the proportion of green materials in public buildings in 2030 more than 50%.

Regional Differentiation

- Asia-Pacific: urbanisation driven infrastructure frenzy, Southeast Asia smart city investment average annual growth of 22% (Jakarta, Indonesia, Hanoi, Vietnam led the way).

- Middle East: mega-projects such as NEOM New City are driving the proportion of modular buildings to 60%, and Saudi Arabia is targeting a 75% localised procurement rate in the construction industry by 2030.

- Europe: demand for refurbishment of old buildings is surging (average annual investment of €280bn) and Passivhaus standards cover 80% of new homes. (EPBD 2030)

- North America: Retrofitting of ageing facilities (hospitals, schools) generates a USD 1.2 trillion market, prefabrication rate rises to 55%.

Reconstruction of the Industry Model

- EPC (design-procurement-construction): traditional general engineering contracting model, focusing on project delivery, with revenue mainly coming from the construction phase.

- Investment-Building-Operation (IBO): extends to the full cycle of “investment-construction-operation”, covering the full life cycle of a project (usually 20-30 years) through annualised returns from operating revenue sharing (e.g. infrastructure REITs).

- The company has transformed from a “construction contractor” to a “comprehensive service provider”, and its revenue structure is tilted towards the operation side (the proportion has increased from 20% to 40%).

ESG Standards Reshapes Industry Landscape.

- Green finance is forcing transformation: Financing threshold: MSCI ESG rating below BBB level increases financing costs by 1.5%-2%, and the EU requires all public projects to submit carbon footprint reports from 2026 onwards.

- Climate bonds: Global building-related green bond issuance is expected to increase from USD120bn in 2025 to USD600bn in 2030.

- Geopolitical Gaming: Technology decoupling: Europe and the US are upgrading export controls on key equipment (e.g., shield machines), forcing China to accelerate domestic substitution (e.g., Beifang Heavy Industry’s market share of shield machines will increase from 18% in 2025 to 35% in 2030).

- Regional cooperation: facilitation of infrastructure investment in Southeast Asia under the framework of RCEP, and China, Japan and South Korea’s joint bidding for Saudi Arabia’s NEOM project amounting to more than US$20 billion.

Regional Market Analysis

The global construction market will show a “multi-polar growth” pattern from 2025 to 2030, but there are some differences in growth momentum, policy orientation, technology application and challenges in each region. Among them, Asia-Pacific dominates the incremental growth, Europe and the United States focus on technological upgrading, the Middle East and Africa rely on resources and policy-driven, and Latin America needs to balance risks and recovery.

Asia-Pacific

The market size is expected to reach US$3.5 trillion in 2025, accounting for more than 45% of the global total, with China, India, and Southeast Asia contributing more than 60% of the share.

Growth driver:

- Urbanisation and infrastructure investment: China’s 14th Five-Year Plan promotes the construction of smart cities and transportation networks (average annual investment of RMB 4 trillion), India’s infrastructure investment plan reaches USD 86 billion (2025), and Southeast Asian countries (e.g., Vietnam and the Philippines) are accelerating urbanisation due to the demographic dividend.

- Green transformation: Asia-Pacific accounted for 60% of the global green building increment, China’s LEED certification projects more than 6,600, Singapore’s “Smart Nation 2030” plan to promote the popularity of smart building technology.

Segmentation:

- Residential Building: 50% of the regional market, with strong demand for affordable housing in China and India.

- Industrial and logistics: the return of manufacturing (such as the U.S. Tesla Shanghai factory) to drive the growth of industrial buildings, Southeast Asia’s e-commerce logistics centre investment surge.

Europe

Expected to reach $1.8 trillion in 2025, with a growth rate of 1.1%-3.8%, with Germany and France as the core of growth.

Growth drivers:

- Green building and refurbishment: the EU mandates Passivhaus compliance for new buildings, raising the share of refurbishment spending to 40% by 2025.

- Infrastructure upgrades: Spain launches high-speed rail network expansion, Poland invests in road projects, France prepares for Paris Olympics to boost infrastructure.

Segmentation:

- Non-residential buildings: Stable demand for commercial complexes and logistics facilities, Germany’s Industry 4.0 policy stimulates smart plant construction.

- Civil engineering: transport networks (e.g. EU’s Connecting Europe Facilities Programme) and energy infrastructure (grid renovation) dominate.

North America

$2.1 trillion by 2025, with the U.S. accounting for 85% of the total, with residential and industrial construction dominating growth.

Growth drivers:

- Smart construction technology: over 70% penetration of BIM technology, increase in 3D printed building pilot projects (e.g. Texas Medical Centre project).

- Energy & Data Centres: AI data centre construction (Big 5 tech giants investing $240 billion by 2025) driving demand for power utilities.

Segmentation:

- Residential Construction: demand for high-end homes on the West Coast is strong, with modular home technology reducing construction cycle time by 20%. Infrastructure: investment in traditional infrastructure (roads, bridges) has slowed, but demand for power grid and new energy facilities (e.g., charging piles) is surging.

Middle East & Africa

The Middle East is expected to be $120bn and Africa $45bn by 2025, with growth rates of 4.5% and 3.8% respectively.

Growth drivers:

- Resource-driven: Saudi Arabia’s “Vision 2030” to promote the construction of NEOM new city (investment of $500 billion), Nigeria’s Lagos urban railway project started.

- Mega-event effect: Qatar’s post-World Cup stadium maintenance demand, Egypt’s new administrative capital construction continue to drive the market.

Segmentation:

- Infrastructure: transport (airports, ports) and energy (oil facilities) dominate, with a 100,000km gap in Africa’s rail network.

- Utilities: Saudi NEOM smart cities and African healthcare infrastructure projects (e.g., WHO-supported hospital networks) are emerging as new growth points.

Latin America

$80bn expected in 2025, with Brazil and Mexico accounting for 60% share and growth picking up to 2.5%.

Growth driver:

- Resource development: port expansion driven by growth in Brazil’s iron ore exports, industrial construction driven by investment in Mexico’s automotive chain.

- Urban Renewal: slum upgrading projects in Rio de Janeiro, Mexico City metro expansion to boost residential and transport demand.

Segmentation:

- Residential construction: expanding middle class drives demand for affordable housing, Brazil’s “My Home My Life” programme covers 1 million households.

- Commercial property: retail and office space recovering, Santiago, Chile tech park attracting multinationals.

Oceania (Australia, New Zealand)

Total size of about $350 billion by 2024 (1.5% of the world), of which Australia accounts for 90% (mainly residential and commercial buildings).

Core demand drivers:

- Green transition: Australia’s requirement for 100 per cent net-zero energy use in new homes by 2030 is driving an 18 per cent annual increase in demand for low-carbon building materials (e.g., recycled timber, phase change materials);

- Disaster defence: frequent hurricanes and hill fires have increased investment in disaster-resistant buildings (e.g. earthquake-resistant structures, fire-resistant materials) to 12%;

- Aging population: the market for age-appropriate modifications (e.g., accessible housing, healthcare facilities) is growing by 10% annually.

Segmentation:

- Residential construction: $120bn (34%), with surging demand for senior housing;

- Infrastructure: $80bn (transport and water dominate);

- Industrial buildings: $50 billion (mining-related facilities).

CIS Region

Total regional size of about US$585 billion (2.5% of the world), of which Russia accounts for 72%.

Core Demand Drivers:

- Energy and resource development:

Russia: Arctic LNG projects (e.g., Arctic 2) drive demand for modular camps and polar engineering technologies, with related investments expected to reach $50bn by 2025;

Kazakhstan: copper and oil field development (e.g. Kashagan oil field) driving mining camps with prefabrication rate increasing to 40%;

Azerbaijan: expansion of the Trans-Caspian Energy Pipeline (TCO), requiring large quantities of steel pipes and welding technology. - Urbanisation and the housing gap:

Russia: the Far East is losing population and the government aims to build 500,000 new housing units by 2030;

Kazakhstan: increasing urbanisation rate from 55% in 2024 to 65% in 2030, generating US$120bn demand for housing and municipal facilities;

Ukraine: 1 million housing units to be rehabilitated for post-war reconstruction, with a €5 billion EU loan. - Infrastructure ageing and upgrading:

Railways and roads: modernisation of Russia’s “Great Siberian Railway” ($30 billion), Kazakhstan’s “Bright Road” programme ($15 billion average annual infrastructure investment). Ports and Logistics: Baku Port, Azerbaijan)

Ports and Logistics: Expansion of the port of Baku in Azerbaijan (to cope with the growth of shipping on the Caspian Sea), construction of a hub for the “China-Europe liner” in Belarus. - Policy orientation:

Russia: the “National Project” programme (2024-2030) identifies infrastructure investment at 7% of GDP, with a focus on nuclear energy, space and transport;

Kazakhstan: Attracting foreign investment in mining infrastructure, offering corporate income tax relief (down to 5%) and tariff exemptions.

Technology Trends

In 2025-2030, construction technology trends will revolve around “intelligence, decarbonisation and efficiency”: AI and robotics to address labour shortages, green building materials and carbon management technologies to meet climate targets, and cross-border collaboration between headline companies and start-ups to accelerate innovation. Policy support and regional differences in demand will drive the multipolarisation of technology development, with developed countries focusing on energy efficiency upgrades and emerging markets on infrastructure scale-up.

Key Technology Development

1. Intelligent Construction Technology

AI & Automation

By 2025, over 64% of construction companies will apply AI technology to optimise project management, with estimated cost savings of 10-20%. AI-powered generative design tools reduce material waste and improve buildability, e.g. Nicky AI’s voice assistant simplifies task allocation and process automation.

Construction Robotics

Global Construction Robotics Market Size to Reach USD 3.63 Billion by 2037, Bricklaying Robots Increase Efficiency by 300%, Drone Patrols and Self-Driving Vehicles Widely Used for On-Site Monitoring and Transportation, e.g., Nextera Robotics’ AI Site Management Robot Captures Images in Real-Time and Analyses Deviations.

3D printing and modular construction

3D printing technology can reduce labour costs by 50-80% and support rapid prototyping of complex structures. Spain’s Aridditive’s concrete printing technology combines environmentally friendly materials to promote green construction; and the UK’s 3D QUANTER’s dual-area printers support multi-material hybrid printing to enhance flexibility and efficiency. Modular construction (e.g. Germany’s TRIQBRIQ’s timber frame system) enables rapid assembly through prefabricated components, reducing on-site waste, and materials can be disassembled and reused, with a 30% reduction in whole-life carbon emissions.

Digital Twin and BIM

Building Information Modelling (BIM) penetration rate is over 70%, combined with digital twin technology to achieve full lifecycle management. Qapture in Austria generates high-precision virtual models through laser scanning to optimise energy management during construction and O&M phases; BIM can simulate carbon emissions at the design stage, reducing rework at a later stage (accounting for 30% of project costs).

2.Virtual Construction and IoT

Virtual construction (VDC) reduces rework costs through simulation (30% of total project costs) and supports energy modelling to reduce carbon footprint. IoT sensors monitor energy consumption and environmental data in real time and combine with AI algorithms to optimise energy strategies, e.g. air conditioning systems are over 33% more energy efficient.

Environmental Protection and Sustainable Development Technologies

Green Building Materials and Low-Carbon Technologies

- Carbon Negative Materials: Carbon Negative Concrete, CLT Wood (annual growth rate of 30%) and self-healing biological materials are gradually replacing traditional building materials. Germany’s TRIQBRIQ’s modular wood structure system can be disassembled and reused, reducing carbon emissions in the whole life cycle.

- Assembled buildings: the global market size will reach US$512.39 billion in 2029, and China is targeting a 30% share of assembled buildings, reducing on-site construction waste through factory prefabrication, with an energy-saving rate of over 60%.

Carbon Management Technology

- Full life cycle management: from design (BIM optimised carbon footprint), construction (intelligent emission reduction), operation (AI energy consumption monitoring) to demolition (waste regeneration), to achieve full chain carbon control. For example, the China Friendship Green Carbon Cloud Platform supports large real estate companies with carbon inventory and peak planning179.

- Blockchain and Carbon Trading: Blockchain technology ensures the transparency of carbon emission data and supports the development of the carbon trading market. Intelligent energy management systems (EMS) integrating photovoltaic and energy storage equipment, such as Shanghai’s pilot ‘photovoltaic fence’ to supply power to construction sites.

Circular Economy and Waste Recycling

- The utilisation rate of construction waste regeneration has increased significantly: 98% of waste materials are recycled at construction sites in the Netherlands; through the solid waste regeneration process of China Construction, the amount of solid waste discharged from concrete production has been reduced from 60 kg/cubic metre to less than 4 kg.

- Construction Waste 3D Printing Technology Converts Concrete Waste into Landscape Components, Reducing Resource Consumption.

Technology Investment Priorities for the Next Five Years

BIM+IoT

highly mature, 150% ROI, focus on design optimisation, construction monitoring;

![]()

Modular Construction

rapid growth, 120% ROI , focus on residential, hotel, data centre;

![]()

Construction Robotics

Growing, 100% ROI, focusing on hazardous and repetitive labour;

![]()

Digital Twin

early application, 90% ROI, focusing on operation and maintenance stage, asset securitisation;

![]()

3D Printed Buildings

experimental stage, 80% return on investment, focusing on emergency housing, customised projects.

Technology suppliers and R&D trends

1.Headline Companies and Start-ups Dominate Innovation

Traditional Construction Giants:

- VINCI Energies, a subsidiary of Vinci, focuses on smart construction equipment and energy management solutions.

- China Construction Technology, a subsidiary of China State Construction Engineering Corporation (CSCEC), focuses on modular construction and BIM platform development.

- Skanska promotes digital construction management platforms (e.g. Aconex) through Skanska UK.

Technology Companies (Cross-Border Empowerment):

- BIM and AI: Autodesk is the leading BIM software company, launching the Constructware platform to realise full-cycle data integration; NVIDIA Omniverse is a meta-universe collaboration platform supporting virtual design and construction simulation for multinational teams; Midjourney is the first BIM software company in the world to launch an AI platform to assist in the design of building solutions. Generative AI-assisted architectural programme design, reducing manual iteration time by 70%.

- Automation and Robotics: Boston Dynamics’ Spot robot for site inspections and safety monitoring. Sarcos Robotics’ Guardian XO exoskeleton device improves worker productivity by 3x.

Construction Tech-Focused Startups:

- Modular Construction: Katerra (USA) has an annual capacity of 1 million m² for modular homes, but a bankruptcy restructuring in 2023 exposes the challenges of scaling the technology. Project Milestone (Netherlands) has delivered a cumulative total of 200 3D-printed concrete homes at a cost 20 per cent lower than traditional methods.

- Green technology: CarbonCure’s (Canada) carbon infused concrete technology reduces carbon emissions by 10%, invested by Microsoft and Amazon. BioMason’s (US) mycelium brick technology has been used in the Oasis Hotel project in Singapore.

- Industrial automation and robotics companies: FANUC’s construction welding robot market share of more than 30%, accuracy of 0.02mm. Komatsu’s unmanned mining trucks and self-driving bulldozers are used in mining projects in Australia; DJI’s drone inspection system covers 80% of high-rise building quality inspection needs.

2.Cross-Border Cooperation and Policy Drive

- Technology enterprises’ empowerment: Aliyun, Microsoft and others provide digital solutions; Jingdong’s “Mercator” standard library for industrial products optimises supply chain management and promotes intelligent upgrading of the construction industry.

- Policy-led R&D: The EU’s “Green New Deal” and China’s “Dual Carbon” strategy incentivise investment in low-carbon technologies. For example, the Chinese government has reduced taxes on green building materials by RMB 2 trillion, and promoted technology standardisation through the “intelligent construction pilot” policy.

3.Regional Differences in R&D Focus

- Developed countries: Europe and the United States focus on stock building renovation and smart cities (e.g., the EU plans to improve building energy efficiency by 32% by 2030), and Nextera Robotics dominates on-site management with its robotics technology.

- Emerging markets: Southeast Asia and the Middle East are dominated by new construction projects, and Saudi Arabia’s NEOM New City has invested more than $500 billion in modular construction and renewable energy systems.

Competitive Landscape and Industry Chain Analysis

Competitive Entity Analysis

Leading Enterprises: Strategic Layouts and Core Competitiveness of Global Construction Giants

Based on the 2025 global construction industry comprehensive competitiveness assessment, the top five global leading enterprises and their core strategic layouts are as follows:

Vinci Group (France)

The world’s largest transportation infrastructure PPP operator, with an operating profit margin of 28% in 2025, leading mega-projects such as London’s HS2 and Saudi Arabia’s NEOM City.

Core Competencies:

Full-cycle revenue model: The “investment-construction-operation” integrated model ensures that operational phase revenue accounts for over 60% of projects like the Saudi Jazan Economic City.

Modular construction: 3D printing technology applied to the Notre-Dame de Paris reconstruction achieved stone restoration precision of 0.1mm, improving complex project efficiency.

Carbon neutrality pathway: Developed carbon-capture concrete technology, reducing emissions by 50% in the EU’s Zero-Carbon School project.

Bechtel (USA)

Global leader in energy and nuclear infrastructure, spearheading the U.S. “Hydrogen Highway” hydrogen refueling station projects, with hydrogen-related revenue accounting for 35% in 2025.

Core Competencies:

Modular nuclear plant technology: Partnered with South Korea’s Doosan to develop small modular reactors (SMRs), reducing construction time to 3 years (vs. 7-10 years traditionally).

Geopolitical resource integration: Dominates mega EPC projects in Middle Eastern petrochemicals, such as the $12 billion Saudi Aramco refinery contract in 2024.

Skanska Group (Sweden)

Global leader in green buildings, with 85% of projects certified as green buildings in 2025, leading EU Green Deal benchmark projects.

Core Competencies:

Zero-carbon construction site solutions: Achieved 100% fossil-free energy use on sites by 2025, with carbon-capture concrete cutting lifecycle emissions by 50%.

Digital twin technology: BIM + IoT integration eliminated construction errors in Helsinki’s Smart Hospital project, enhancing complex project management.

Hochtief (Germany)

Europe’s largest multinational construction group, with overseas revenue exceeding 65% in 2025, leading mega-projects like Sydney Airport expansion.

Core Competencies:

Airport & transportation hub expertise: Involved in 6 of the world’s top 10 airports, with intelligent construction management systems achieving ±2-day schedule precision.

Circular economy model: Achieved 95% construction waste recycling, winning the EU Sustainable Building Gold Award for Munich’s Eco-Housing project.

China State Construction Engineering Corporation (CSCEC)

Overseas revenue accounted for 28% in 2025, operating in over 130 countries.

Core Competencies:

Supertall building dominance: Built 60% of global skyscrapers over 300m, using “sky-rising building machines” to achieve a 3-day-per-floor construction speed.

Belt & Road expansion: 45% of new contracts came from BRI countries, leading cross-border projects like China-Laos Railway and Jakarta-Bandung HSR.

Through multi-dimensional screening, leading enterprises have established a “technology-market-policy” trinity moat, moving beyond mere scale advantages. Future competition will focus on cross-sector technology integration (e.g., construction metaverse, hydrogen-powered construction) and geopolitical supply chain resilience (e.g., critical mineral self-sufficiency).

Emerging Players: Technological Innovation and Regional Breakthroughs

Based on technological disruptiveness, market penetration, and regional expansion, the top five global construction industry emerging players in 2025 are:

Project Milestone (Netherlands)

3D-printed concrete housing with daily output of 50㎡ per machine, 20% cost reduction vs. traditional methods. Applied in Amsterdam’s “Sun City” low-carbon housing (200 units delivered).

Winsun (China)

3D-printed buildings (largest single structure: 12,000㎡), reducing material costs by 30%. Used in Dubai’s “Museum of the Future” walls.

CarbonCure Technologies (Canada)

Leader in low-carbon materials & carbon capture. CO₂ mineralization concrete increases strength by 10% and cuts lifecycle emissions by 10%. Partnered with Microsoft and SoftBank on AI carbon-tracking platforms.

Autodesk Construction IQ (USA)

Digital lifecycle management for construction. AI risk prediction covers 60% of global Top 100 contractors, boosting project margins by 8% (e.g., Burj Khalifa maintenance).

Buildots (Israel)

AI-driven construction progress & quality management. Covers 12,000 global sites, reducing material waste by 18% and schedule errors to <2%.

Collaboration Models: Synergistic Pathways in Global Industry Chain Restructuring

To counter rising costs and tech disruption, firms adopt four collaboration models:

Cross-border JVs & Localization Alliances

Example: China Railway Construction + Vinci JV for East African rail projects (Chinese funding + French design).

Tech Alliances & Patent Sharing

Example: LG Energy + Doosan Bobcat’s standardized battery packs cut electric excavator costs by 20%.

PPP + ESG Financing

Example: EU’s Sustainable Finance Taxonomy directs green bonds (e.g., Vinci’s €1.5B bond in 2025) to retrofit old buildings.

Digital Ecosystem Platforms

Example: Autodesk’s “Construction Metaverse” with Top 50 firms reduces rework costs by 18%.

Collaborative Value and Synergistic Effects

Value for Industry Giants

- Technology Upgrades: Acquiring startups to address gaps in digital and low-carbon technologies (e.g., CSCEC’s acquisition of Katerra to expand modular construction capabilities).

- Market Expansion: Leveraging the local expertise of emerging firms to enter new regions (e.g., NEOM Fund partnering with CSCEC to penetrate the Middle Eastern market).

- Capital Appreciation: Investing in high-growth startups (e.g., Siemens investing in NVIDIA Omniverse to explore the metaverse).

Value for Emerging Enterprises

- Resource Access: Gaining funding, distribution channels, and project experience from industry leaders (e.g., CarbonCure accessing global supply chains via LafargeHolcim).

- Brand Endorsement: Enhancing customer trust through collaborations with major players (e.g., Autodesk and Vinci co-publishing industry white papers).

- Risk Mitigation: Relying on giants to navigate policy and currency fluctuations (e.g., NEOM projects backed by Saudi sovereign funds).

Strategic Recommendations for Enterprises

- Establish Corporate Venture Capital (CVC) funds to systematically invest in startups (e.g., CSCEC’s $5 billion “Future Construction Fund”).

- Open core data interfaces to foster developer ecosystems (e.g., Autodesk’s free BIM API trial program).

- Prioritize partnerships with regional leaders (e.g., African startups collaborating with China Communications Construction Company to enter Belt and Road markets).

- Avoid over-reliance on a single giant; diversify collaboration risks (e.g., CarbonCure partnering with both LafargeHolcim and HeidelbergCement).

Industry Chain Value Distribution

| Segment | Value Share | Key Traits | Profit Margin | Major Players |

|---|---|---|---|---|

| Upstream | 35%-40% | Materials, equipment, design | 5%-15% | Conch Cement, Sany Heavy, Autodesk |

| Midstream | 45%-50% | EPC, subcontracting | 3%-8% | CSCEC, Vinci, Skanska |

| Downstream | 15%-20% | Maintenance, REITs, sales | 8%-15% | JLL, Blackstone, Vanke Property |

Upstream: Raw Materials & Core Tech Suppliers

Traditional Materials Dominance

- Cement: Global market to hit $554.7B by 2030 (CAGR 4.75%), with Asia-Pacific supplying 50%+ output.

- Steel: 39% of global demand is for construction, but high inflation curbs Western demand.

Green Materials and Technological Innovations

- Low-Carbon Cement: Blended cement, which reduces carbon emissions and enhances durability, accounted for 45% of the market share in 2024 and is projected to exceed 60% by 2030.

- Bio-Based Construction Materials: Technologies such as Hycrete’s waterproof concrete—modified chemically to reduce maintenance costs—have been widely adopted in infrastructure projects across Mexico and the United States. The related market size grew by 12% in 2024.

- Smart Equipment: Hydrogen-powered construction machinery by Caterpillar and AI-driven construction systems from Komatsu have improved energy efficiency, reducing construction costs by 15%-20%.

Supply Chain Concentration and Regional Disparities

- Asia-Pacific Dominance in Production: China contributes 55% of global cement output, while Vietnam has emerged as a key exporter, with 40% of its total production volume exported in 2024.

- Technological Barriers in Europe and North America: European firms (e.g., LafargeHolcim) leverage carbon capture, utilization, and storage (CCUS) technologies to secure their position in high-end markets. By 2030, the price premium for green cement is expected to reach 30%.

Midstream: Construction Enterprises and Engineering Contractors

The midstream segment accounts for approximately 45%-50% of the total value chain, encompassing design, construction, and project management, characterized by a dual pattern of global competition and regional specialization.

Comprehensive Industrial Chain Deployment by Leading Enterprises

- Chinese State-Owned Enterprises: Eight major central SOEs including China State Construction Engineering Corporation (CSCEC) and China Communications Construction Company (CCCC) hold 30% of global EPC project shares. In 2024, their overseas newly signed contracts exceeded RMB 2.1 trillion, with a strategic focus on Belt and Road Initiative (BRI) countries.

- European Giants: France’s Vinci dominates transportation infrastructure through PPP models, with green project investments projected to rise to 40% by 2025, covering landmark projects such as London’s HS2 railway.

Differentiated Competition by Emerging Players

- Modular Construction: Sweden’s Skanska and China International Marine Containers (CIMC) Modular utilize MiC technology to reduce construction timelines by 30%, increasing market share to 15% in data centers and public housing.

- Digital Service Providers: Procore and Glodon’s BIM collaboration platforms empower small and medium-sized contractors. The market size is expected to reach $32 billion by 2025, with an annual growth rate of 18%.

Regional Market Divergence

- Middle East and Southeast Asia: Saudi Binladin Group leverages sovereign wealth funds for mega-projects (e.g., Red Sea Tourism Zone), with Chinese technology exports exceeding 50%.

- Latin America and Africa: Smart city initiatives in Mexico and data center construction in Brazil drive localized cooperation with Chinese firms (e.g., PowerChina), with the Latin American market growing at 25% in 2025.

Downstream: Operation and Maintenance Services

The downstream segment represents 15%-20% of the value chain, centered on asset management, maintenance upgrades, and circular economy, with the highest growth potential.

Infrastructure Operations

- Smart Cities and Data Centers: The Latin American data center construction market is projected to grow at an 18.6% CAGR from 2024 to 2030, with Brazil and Mexico integrating renewable energy (e.g., wind power PPAs) to reduce operational costs.

- Transportation Network Maintenance: Global demand for aging infrastructure upgrades surges, with the U.S. Infrastructure Investment and Jobs Act driving a 7% annual increase in maintenance expenditures from 2025 to 2030.

Circular Economy and ESG Services

- Construction Waste Recycling: European policies mandate 75% material reuse, propelling recycling technologies (e.g., concrete crushing and regeneration) to a $120 billion market by 2030.

- Carbon Asset Management: Skanska’s “Zero-Carbon Site” solution, incorporating carbon capture and photovoltaic wall technologies, helps clients reduce lifecycle emissions by 50%, commanding a 20% service premium.

Digital Operation Platforms

- Construction Metaverse: Autodesk’s collaborative platform, developed with global top 50 construction firms, reduces rework losses by 18%, with users expected to surpass 1 million by 2025.

Future Trends: Industrial Chain Value Restructuring

Upstream Expansion: Vertical Integration by Industry Leaders

- Vinci Group: Acquired Spain’s Aldesa to control building material supply chains, reducing costs by 8%.

- CSCEC: Established in-house concrete mixing plants, lowering raw material costs from 45% to 40% of total expenses.

Midstream Consolidation: Specialization and Industrialization

- Modular construction firms (e.g., Katerra) increase penetration rates, raising construction profit margins from 5% to 8%.

- Specialty subcontractors (e.g., curtain wall and steel structure firms) expand market share to 25%.

Downstream Boom: Asset Management and Data Monetization

- The smart building operation and maintenance market will reach $200 billion by 2030 (12% CAGR).

- Construction data trading platforms (e.g., BIM model sharing) grow at 30% annually.

Core Conclusions on Value Distribution

- Upstream: High cost proportion but low profit margins; technological breakthroughs (e.g., low-carbon materials) are critical.

- Midstream: Economies of scale dominate; industrialization and automation are key to profit growth.

- Downstream: Long-term revenue models emerge, driven by ESG and digitalization.

Strategic Recommendations for Enterprises

- Traditional Construction Firms: Integrate upstream (e.g., establish material production bases) and extend downstream (e.g., launch operation and maintenance subsidiaries).

- Technology Companies: Target midstream pain points (e.g., AI-based construction monitoring) or downstream data monetization (e.g., BIM platform subscriptions).

- Investors: Focus on downstream REITs and green-tech startups while mitigating cyclical risks in upstream sectors.

Policies and Regulations

Industry-Related Policies and Regulations

The global construction industry’s policy framework for 2025-2030 exhibits distinct trends toward “green transformation, standardization, and regional coordination.” Below is a classification of representative policies and regulations by region and global initiatives:

Europe: Green Building and Energy Efficiency Dominance

- Revised Energy Performance of Buildings Directive (EPBD):

- Key Provisions: Mandates rooftop solar systems for all new EU residential buildings from 2030, with public buildings gradually adopting renewables based on techno-economic assessments. Phases out fossil fuel-based heating/cooling equipment by 2040, banning subsidies for standalone fossil fuel boilers from 2025.

- Objective: Achieve zero-carbon emissions in buildings, supporting the EU’s 2050 climate neutrality goal. Buildings currently account for 40% of EU energy consumption and 36% of greenhouse gas emissions.

- EU Taxonomy for Sustainable Activities: Defines criteria for sustainable economic activities in construction, directing investments toward green retrofits, low-carbon materials, and smart construction technologies.

Asia-Pacific: Low-Carbon Transition and Technological Advancement

- China’s “Dual Carbon” Policy Framework:

- Building Energy Efficiency and Green Building Development Plan: Requires prefabricated buildings to comprise 30% of new constructions by 2025, with green materials exceeding 50% penetration. Promotes nationwide BIM adoption.

- Local policies (e.g., Beijing, Shanghai): Mandate green building standards for new projects; Shenzhen enforces stricter environmental controls via Drinking Water Quality Inspection Technical Standards.

- India’s “Manufactured Sand (M-sand) Mandate”: Maharashtra mandates M-sand to replace natural sand in construction, supplemented by tax incentives, to curb ecological damage.

- Japan’s Revised Building Energy Efficiency Act: Requires all new buildings to meet Zero Energy House (ZEH) standards by 2030, with subsidies for building-integrated photovoltaics (BIPV).

North America: Market-Driven and Regulatory Approaches

- U.S. Inflation Reduction Act (IRA): Offers tax credits (e.g., 30% for heat pump installations), targeting annual CO₂ reductions of 150 million tons in construction.

- Canada’s Updated National Building Code (NBC): Mandates net-zero energy standards for new buildings from 2025 and low-carbon concrete (embodied carbon ≤300kg/m³).

Oceania: Industrialized Construction and Sustainability Certification

- Australia’s National Housing Accord: Aims to build 1.2 million homes by 2030 (50% prefabricated), cutting duration 30–40%. Requires low-carbon materials (e.g., recycled timber, low-VOC paints) and BIM-based digital management.

- New Zealand’s Revised Building Code: Mandates ±1mm construction accuracy via BIM/IoT-enabled digital twins and 95% waste recycling for public projects.

CIS: Regional Coordination and Localized Technology

- Eurasian Economic Union (EAEU) Green Building Standard: Enforces low-carbon concrete (≤350kg CO₂/m³) and 10% tax breaks for steel structures. Promotes modular prefabrication for high-rises (8.0-magnitude earthquake resistance).

- Russia’s Building Energy Efficiency Program: Targets green retrofits for 80% of Soviet-era buildings by 2030, using smart HVAC and solar roofs to reduce energy use by 40%.

Africa: PPP Models and Localization Policies

- South Africa’s Green Building Council Certification: Government projects require Green Star certification, emphasizing passive design (e.g., double glazing) for extreme climates. Prioritizes rural solar microgrids and EV charging networks.

- DRC’s Public Procurement Law & PPP Framework: Localization rules: Foreign mining infrastructure investors must hire ≥70% local staff and transfer technology. Subcontractors must be ≥51% locally owned. Dispute resolution: 30-day arbitration via ICSID-compliant committees.

- African Union’s Infrastructure Decade Plan: Focuses on transcontinental transport (e.g., Pan-African High-Speed Rail) and renewables (e.g., North Sea Wind), using “minerals-for-infrastructure” financing.

Global Initiatives & Cross-Border Collaboration

- UN “Building Breakthrough” Initiative: Led by France/Morocco, aims for near-zero-emission resilient buildings as the global norm by 2030, integrating targets into NDCs.

- International Construction Measurement Standards (ICMS): Developed by RICS/Arup et al., standardizes cost classification to curb budget overruns (90% of mega-projects historically exceed budgets). Adopted by G20.

- Global Buildings Climate Tracker: Monitors progress: 2023 saw construction’s first GDP-decoupled emissions, but operational CO₂ must drop from 9.8Gt to 4.4Gt by 2030.

Environmental Regulations

Shift from emission limits to lifecycle management:

Carbon Pricing: EU CBAM taxes imported building materials; China’s ETS (May 2024) covers construction quotas.

Pollution Control: China’s GB/T 50640-2023 mandates dust/noise/waste reduction; EU CPR requires Environmental Product Declarations (EPDs).

Waste/Water: India regulates construction wastewater; Germany’s Circular Economy Act enforces 70% material recycling.

Industry Standards & Certifications

Harmonization for transparency:

ICMS: Covers energy/transport/health projects.

EPD Certification: ISO 21930:2017/China’s GB/T 45005-2024 enables mutual recognition. France mandates EPDs; Germany uses them to bypass trade barriers.

Smart Construction Safety:

ISO/PAS 8800 (Horizon’s AI vehicle safety).

IEC 62443-4-2 (Advantech’s IIoT cybersecurity).

Opportunities and Challenges

Opportunities

The global construction industry is poised for multidimensional growth opportunities from 2025 to 2030, driven by accelerated green transformation, emerging market demand, technological innovation, and synergistic policy and capital support. The following analysis highlights key opportunities from a global perspective:

Green Building Revolution: The Core Driver of Global Low-Carbon Transition

Market Size & Emission Reduction Potential

A joint report by the World Economic Forum (WEF) and Boston Consulting Group (BCG) indicates that the construction sector can achieve 80% of its decarbonization potential through 11 key measures (e.g., zero-carbon materials, biophilic design), unlocking a $1.8 trillion market opportunity by 2030.

China, the world’s largest building materials producer (accounting for over 50% of global output), will lead the restructuring of the global green building value chain through its green material standards and “Dual Carbon” policies.

Policy & Standard Leadership

The EU’s Energy Performance of Buildings Directive (EPBD) mandates the phase-out of fossil fuel-based building systems by 2040, accelerating the adoption of building-integrated photovoltaics (BIPV).

The U.S. Inflation Reduction Act (IRA) offers 30% tax credits for green retrofits, boosting heat pump installations and renewable energy projects.

Emerging Market Infrastructure Demand: Urbanization & Resource Development

Asia-Pacific & Africa’s Construction Boom

Southeast Asia (Indonesia, Vietnam, Philippines) is experiencing rapid urbanization, driving 3.8% annual construction growth. India’s M-sand policy promotes a circular economy, adding 5%+ to infrastructure investment growth.

Sub-Saharan Africa, leveraging critical mineral development (e.g., Tanzania-Zambia Railway upgrades) and PPP models, attracts Chinese firms for mining and energy projects, with construction spending growing at 3.8%.

Mega-Projects in the Middle East

Saudi Arabia’s Vision 2030 invests $500 billion in NEOM City, while the UAE expands ports and smart cities. Gulf nations plan to add 620 GW of solar capacity.

Technological Innovation & Digital Transformation: Efficiency Boosters

Smart Construction Technologies

Global BIM adoption is projected to reach 80%, with AI-driven scheduling reducing material waste by 15%.

IoT-enabled job site management optimizes real-time equipment and material tracking, improving resource efficiency.

Modular & Industrialized Construction

Skanska (Sweden) and CIMC Modular (China) use Modular Integrated Construction (MiC) to cut project timelines by 30%, capturing 15% market share in data centers and public housing.

Regional Economic Recovery & Policy Tailwinds

China’s Infrastructure Push & “Three Major Projects”

The Chinese government has allocated ¥7 trillion in 2024 infrastructure funding, prioritizing flood control, new energy, and “dual-use” emergency facilities in key city clusters (e.g., Beijing-Tianjin-Hebei, Yangtze River Delta).

Moderate Growth in North America & Europe

The U.S. Infrastructure Investment and Jobs Act (IIJA) supports 3.6% growth in civil engineering.

The EU’s Carbon Border Adjustment Mechanism (CBAM) incentivizes green material upgrades.

Global Supply Chain Restructuring & Collaborative Development

Cross-Border Cooperation & Standardization

The International Construction Measurement Standards (ICMS), adopted by G20 nations, harmonizes cost classification, reducing budget overruns in multinational projects.

Chinese SOEs (e.g., CSCEC, PowerChina) leverage “Investment-Construction-Operation” models, securing ¥1.18 trillion in overseas contract revenue under the Belt and Road Initiative (BRI).

Green Finance & ESG Investment

Global green bond issuance exceeds €15 trillion, funding low-carbon construction.

The EU’s Sustainable Finance Taxonomy directs capital toward green infrastructure.

Challenges

Environmental & Carbon Emission Pressures

The construction sector accounts for 37% of global carbon emissions (including operational and material production phases). To meet climate goals, operational emissions must drop from 9.8 billion tons to 4.4 billion tons by 2030, yet only 3.3% of global buildings currently comply with net-zero standards (UNEP, 2024).

Developing countries face 2.1x higher carbon intensity in building material production than developed nations, making green transition costs prohibitive.

Lagging Technology & Digital Transformation

Global construction productivity growth averages just 1% annually, far below manufacturing’s 3.6%. In developing countries, BIM adoption remains below 30% (McKinsey, 2025).

SMEs struggle with digital transformation costs exceeding 15% of annual profits, creating financial barriers to modernization.

Geopolitical & Compliance Risks

The EU’s Carbon Border Adjustment Mechanism (CBAM) imposes carbon tariffs on imported construction materials, while Chinese contractors face over 5% project suspension losses due to political instability in overseas markets (CHINCA, 2025).

Emerging markets (e.g., Africa) are tightening ESG compliance, increasing reporting costs by 20%-30%.

Financial & Debt Burdens

Chinese state-owned construction firms carry an average 75% debt-to-asset ratio, with mounting bond repayment pressures (Wind Data, 2025).

Global real estate investment has declined for two consecutive years (-10.1% YoY in 2024), exacerbating cash flow risks.

Labor Shortages & Skills Gaps

The global construction workforce shrinks by 2.3% annually, while demand for digital specialists (BIM engineers, AI operators) faces a 40% shortfall (ILO, 2025).

Developing countries spend 8%-12% of project budgets on skilled labor training—far above the global average.

Strategic Responses

To address the aforementioned challenges, the following countermeasures are proposed:

Accelerate Full Lifecycle Decarbonization

Technological Pathways: Promote carbon-capture concrete (mandated under the EU Energy Performance of Buildings Directive (EPBD)) and building-integrated photovoltaics (BIPV) (per China’s Green Building Evaluation Standards).

Policy Coordination: Establish a global carbon footprint database for construction materials (aligned with ISO 21930). Redirect carbon border tax revenues to fund green R&D initiatives.

Scale Up Smart Technology Adoption

Tool Deployment: China targets 80% BIM adoption by 2025; the EU mandates Digital Building Passports for data interoperability.

Cost Mitigation: Governments should subsidize digital transformation for SMEs (e.g., Germany’s “Industry 4.0” fund) to lower SaaS adoption barriers.

Build Risk-Hedging Frameworks

Localized Operations: Implement the “1+2+N+X” overseas management model (e.g., PowerChina’s Jakarta-Bandung HSR project), achieving 60% local procurement rates.

Standard Harmonization: Adopt International Construction Measurement Standards (ICMS) to reduce cross-border compliance costs.

Innovate Financing & Asset Optimization

Green Finance: Expand carbon-neutral bonds (global issuance exceeded €15 trillion in 2024); test infrastructure REITs (e.g., CRCC’s pilot).

Business Model Upgrade: Shift to EPC+O (Engineering-Procurement-Construction-Operation) for 5%-8% higher ROI on projects.

Industry-Education Integration & Automation

Workforce Development: Germany’s dual vocational training cuts skilled labor training to 2 years; Chinese SOEs partner with universities for smart construction academies.

Robotic Replacement: Skanska’s bricklaying robots boost efficiency 5x; Komatsu’s autonomous mining trucks reduce labor dependency by 40%.

List of Data Sources

International Organizations & Multilateral Reports

Analysis of Labor Trends in the Construction Industry International Labour Organization (ILO), 2025

White Paper on Green Finance for Construction Decarbonization Climate Bonds Initiative (CBI), 2024

UN “Building Breakthrough” Initiative COP28 Conference Document, 2023

International Construction Measurement Standards (ICMS) Royal Institution of Chartered Surveyors (RICS) & Hong Kong Institute of Surveyors (HKIS), 2017 (2025 Revised Edition)

Global Green Building Market Data International Energy Agency (IEA), February 2025

Government Policy Documents

Case Studies on Smart Construction Technology Applications Ministry of Housing and Urban-Rural Development of China (MoHURD), 2025

Energy Efficiency and Green Building Development Plan MoHURD, 2025

Energy Performance of Buildings Directive (EPBD) European Parliament, March 2024

EU Carbon Border Adjustment Mechanism (CBAM) Implementation Guidelines European Commission, 2024

Green Construction Evaluation Standards for Building and Municipal Engineering Ministry of Ecology and Environment of China, May 2024

M-Sand Policy Government of Maharashtra, India, May 2025

Inflation Reduction Act (IRA) U.S. Government, 2022

Industry Research & Corporate Whitepapers

Global Construction Industry Outlook 2025 China Concrete & Cement-Based Products Association, 2025

Building a Global Green Building Value Chain World Economic Forum × Boston Consulting Group (BCG), 2024

Global Construction Market Analysis Report Third-Party Independent Research Firm, 2025

Strategic Analysis of Overseas Expansion by China’s Top Eight Construction SOEs Engineering Industry Research Platform, 2025

Segmented Market Research and Operational Strategies for the Construction Industry Construction Industry Analysis Platform, 2024

Latin America Data Center Construction Market Outlook 2025-2030 Research and Markets, 2025

Market Data & Industry Analysis

Global Construction Machinery Industry’s Most Promising Enterprises Ranking CCM Industry Research Institute, 2025

Competitive Landscape Analysis of Global Construction Equipment Qichamao Industry Research Institute, 2025

Market Share and Ranking of Global Construction Equipment Enterprises Glonghui Research Institute, 2025

Smart Construction Equipment Market Report Verified Market Reports, 2025

Impact of US Tariffs on Construction Equipment Markets Verified Market Reports, 2025

Technical Standards & Certification Systems

ISO/PAS 8800 Safety Certification Horizon Robotics × exida Certification Body, April 2025

IEC 62443-4-2 Industrial Cybersecurity Certification Bureau Veritas × Advantech, May 2025

Industry Media & Special Reports

Going Global: Construction Enterprises’ Brand Globalization Construction Times, 2025

Global Green Building Revolution Special Report FromGeek Technology Media, 2024

Strategic Analysis of Volvo Construction Equipment Eastday Industry Channel, 2025

Corporate Competitiveness Analysis

User Historical Dialogues Analysis on Global Leading Enterprises’ Competitiveness (Integrated data from WEF, BCG reports, and corporate annual reports)