Over the past decade, the global cement and aggregates industry has undergone a profound restructuring. Companies are shifting from relying on externally sourced aggregates to actively establishing their own crushing plants. This strategic move allows them to control aggregate resources and create an integrated production system encompassing mining, aggregates, cement, and concrete.

As cost pressures rise, project standards are elevated, and environmental regulations become stricter, the importance of controlling raw material quality and ensuring stable supply has become increasingly critical. Many international and regional construction materials groups are recognizing that maintaining control over the crushing process is essential for gaining a competitive edge in the future. This strategic shift is quietly reshaping the landscape of the global building materials industry.

Why are the Cement & Aggregates Giants towards In-House Crushing Plants?

Global Aggregate Supply Chain Faces Cost Pressures

-

In recent years, the global prices for externally sourced aggregates have continued to rise, influenced by several key factors:

- Regionality and Irreplaceability: High transportation costs and uneven resource distribution have led to a decline in available extractable resources due to urban expansion and regulatory approvals, resulting in price hikes.

- Rising Energy and Logistics Costs: Fluctuations in oil prices and port congestion have increased transportation costs and brought greater uncertainty to the market.

- Increased Supply Chain Risks: Delays in mining permits and environmental inspections have resulted in production stoppages, making the establishment of in-house crushing systems crucial for maintaining business stability.

High-Performance Concrete Drives Aggregate Quality Upgrades

In major national projects, high-Performance Concrete (HPC, UHPC) has become the norm for applications such as bridges and ports, demanding stricter requirements for aggregates. These include uniform particle shape, low amounts of flaky and elongated fragments, precise gradation, and controlled clay content. Externally sourced aggregates often fail to provide long-term stability; switching suppliers can lead to significant variability in concrete performance.

Global ESG and Green Mining Trends as Driving Forces

In multiple countries, the standards for ESG (Environmental, Social, and Governance) and green mining management are progressively rising. The decentralized and less controllable nature of external sourcing puts companies at a disadvantage in ESG scoring. In many regions, the capability for green production has become essential for cement and aggregate companies to secure large projects. Consequently, establishing in-house crushing plants is no longer just a strategic business decision but also a response driven by government policies and environmental regulations.

How Global Cement & Aggregates Giants Build Their Own Crushing Systems

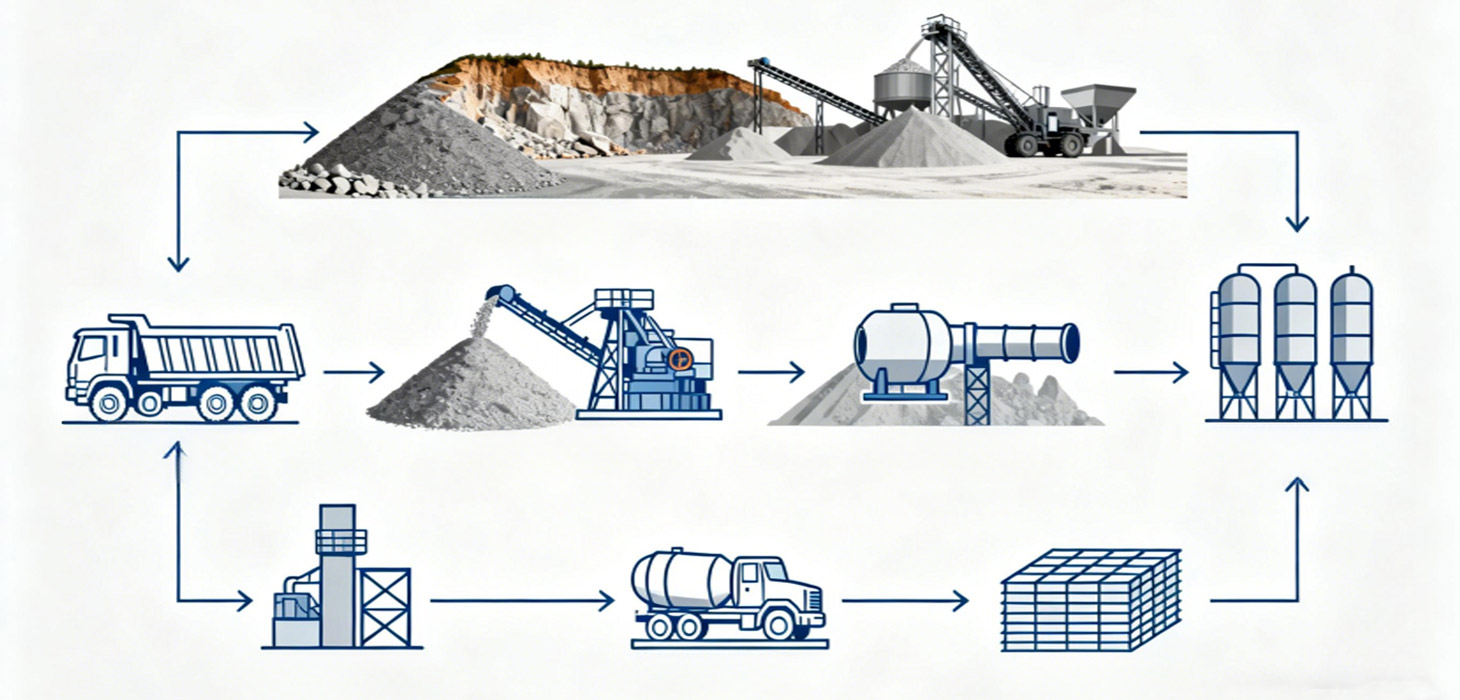

Accelerating Vertical Integration from “Mine to Clinker”

In the past, the competitive focus for cement companies rested on several key areas: clinker costs, mill efficiency, and market channel coverage. However, as the industry has evolved, the emphasis has gradually shifted toward a more comprehensive and diversified vertical integration system. The construction of this new system includes several critical stages:

- Mine Planning: Enterprises must strategically layout and develop mineral resources to ensure a stable supply of raw materials.

- Crushing Systems: Efficient crushing systems not only affect aggregate quality but also determine the production efficiency of cement and concrete.

- Aggregate Products: High-quality aggregates are fundamental for producing high-performance concrete.

- Cement Clinker: As the core raw material for cement production, clinker directly impacts both costs and product quality.

- Concrete: This serves as the foundational material in construction and infrastructure projects.

- Prefabricated Components: With increasing demands for efficiency and quality in the construction sector, the significance of prefabricated components is becoming more pronounced.

To realize this complete vertical integration, many international giants are strategically acquiring mines, expanding crushing plants, and investing in mobile crushing equipment across the entire value chain. This integrated approach yields three core values:

- Enhanced Raw Material Control: Companies can better manage mineral resources, reducing the volatility of raw material supply.

- Improved Production Synergy: The synergies between aggregate and cement production boost overall efficiency and product quality.

- Market Barriers: This model effectively raises entry barriers in regional markets, establishing competitive advantages.

Consequently, constructing self-owned crushing plants has increasingly become a standard strategic investment for large building materials groups, helping them gain an edge in a fiercely competitive landscape.

Technological Upgrades as the Core Driving Force for New Crushing Plant Construction

Modern crushing plants have evolved beyond the traditional definition of simple “coarse, secondary crushing, and screening” combinations. They now represent a smart, collaborative, and comprehensive system. Current technological trends in the industry are primarily reflected in several aspects:

Rapid Adoption of Automation and Intelligent Control Systems

The application of automation and intelligent control systems has become a hallmark of modern crushing plants. These systems include:

- Material Level Monitoring Systems: These continuously monitor the material levels in storage silos, ensuring production continuity.

- Remote Control Central Rooms: Centralized management of the entire production line enhances response times and operational efficiency.

- Automatic Crushing Chamber Adjustments: These systems can automatically adjust crushing parameters based on material characteristics, improving crushing efficiency.

- AI Predictive Maintenance: Employing AI technology allows for timely fault warnings, significantly reducing downtime.

Mainstream Efficient Crushing and Screening Equipment

Equipment in modern crushing plants is constantly upgraded, with a focus on:

- Multi-Cylinder Hydraulic Cone Crushers: These achieve higher crushing efficiency and more precise particle shape control.

- High-Frequency Vibrating Screens: These enhance sorting efficiency and enable finer aggregate grading.

- Modular Crusher Plants: Easy to configure and expand, suitable for varying project needs.

- Mobile Wheeled Type and Tracked Crushers: Offering high flexibility, adaptable to different terrain.

These advanced devices significantly enhance aggregate quality and stability, ensuring the production of high-performance concrete.

Comprehensive Integration of Environmental Technologies

With rising environmental awareness, stone crusher plants are increasingly incorporating various environmental technologies, including:

- High-Efficiency Bag Filters: Reducing dust emissions protects surrounding environments.

- Noise-Canceling Covers and Enclosed Belts: These significantly decrease noise pollution, meeting environmental regulations.

- Atomized Spraying Systems: Further lowering airborne dust levels.

- Energy-Saving Motors and Variable Frequency Drives: Enhancing energy efficiency while lowering consumption.

The application of these technologies ensures that modern crushing plants excel in environmentally friendly operations.

Emergence of Digital Twin Mine Management

Many large building material companies are gradually introducing digital twin technology to simulate and optimize mine management processes. Digital twin models support enterprises in several areas of refined management:

- Capacity Planning: Facilitating reasonable configuration of future capacities based on real data.

- Resource Utilization: Improving mining resource extraction efficiency and reducing waste.

- Line Design and Equipment Selection: Optimizing production workflows to enhance operational efficiency.

By integrating traditional mine management with digital technologies, companies are progressing toward the era of smart mining.

Case Focus: Strategic Practices of Cement & Aggregates Giants

Case 1: International Giant – Holcim’s “Aggregate First” Strategy

Global construction materials leader Holcim emphasizes its aggregate business as a strategic core. By establishing modern crushing plants, the company enhances resource utilization efficiency. At its integrated facility in Europe, Holcim has implemented a fully enclosed, zero-emission crushing and screening system. This innovation not only meets the internal aggregate needs for cement and concrete production but also allows for the sale of surplus high-quality aggregates, creating a significant profit center. Through this “aggregate first” model, Holcim ensures the stability and profitability of its global operations, solidifying its market position.

Case 2: China Conch Cement’s “T-shaped Strategy” and Aggregate Expansion

China Conch Cement has carved out its niche in the industry with its renowned “T-shaped strategy.” This approach focuses on building clinker bases at raw material locations and establishing crushing plants and grinding equipment in market areas, with recent expansions into the aggregate sector. According to its annual report, Conch Cement continues to increase its aggregate production capacity by leveraging abundant mineral resources for large crushing station construction. In one production base in Anhui, Conch has built an annual aggregate project with a capacity of ten million tons, utilizing an enclosed transport corridor to supply materials for cement production. This strategy effectively reduces costs and enhances supply chain security. As a result, the aggregate business has become Conch Cement’s fastest-growing segment, yielding substantial profit returns.

Case 3: Heidelberg Materials

Heidelberg focuses on establishing a low-carbon aggregate production system, centered around smart mining and efficient crushing plants to achieve environmentally friendly production. By building its own stone crushing plants, the company ensures both high efficiency and environmental sustainability, marrying resource utilization with ecological protection. This strategic direction not only boosts production efficiency but also strengthens Heidelberg’s competitive edge in the global market.

Advantages of Building In-House Crushing Plants: Operational and Financial Benefits

Cost Reduction and Profit Margin Enhancement

Industry data indicates that large enterprises constructing their own crushing systems can achieve significant cost advantages, including:

- Reduction in raw material costs by 20% to 35%

- Decrease in transportation costs by approximately 30%

- Significant reduction in the volatility of procurement prices

- More stable and predictable EBITDA

In the cement and aggregate industry, which often operates on thin margins, such cost advantages directly enhance a company’s competitiveness.

Controlled Production Capacity and Enhanced Supply Stability

The benefits of self-built facilities include:

- Flexibility to adjust production volume according to demand

- Long-term stable supply for large projects

- Avoidance of production line shutdowns

- Implementation of regional supply strategies

Additionally, companies can achieve product customization capabilities, gaining a competitive edge in high-grade engineering projects.

Customized Production Capabilities

In-house crushing plants allow for tailored production based on project requirements. For example:

- Maintaining a strict control over flake shape to industry-leading standards

- Adjusting gradation for high pumpability concrete

- Providing specialized aggregates with high abrasion resistance and strength for specific applications

In port projects, companies can customize high abrasion-resistant aggregates according to erosion resistance requirements. For high-rise buildings, they can adjust flake content to improve concrete pumpability. In this way can the enterprises win more bids for large-scale projects, enhance product quality differentiation, and enter higher-margin engineering supply chains.

Easier Compliance with Environmental and Regulatory Standards

Building in-House aggregate crushing plants facilitates the achievement of:

- Green mine standards

- Environmental impact assessment approvals

- Energy conservation and consumption reduction requirements

- Safety production management standards

- ESG disclosure standards

Consequently, businesses can lower the risk of non-compliance, enhance brand reputation, and gain additional points for government projects. This advantage is particularly crucial in regions where environmental regulations are becoming increasingly stringent.

Future Outlook: Integration, Technology and Sustainability

This strategic shift is not just a passing trend; it marks the beginning of a fundamental transformation in the industry. As industry giants continue to solidify their control, we can anticipate several key trends emerging over the next few years:

Deepening from “Supply Chain Control” to “Value Chain Leadership”

Currently, in-House crushing plants primarily serve to ensure raw material supply security. In the future, this model will evolve into a new profit center. Large companies will no longer be content with internal supply; instead, they will leverage their excess crushing capacity to provide customized crushing services for external construction and demolition projects. This shift enables them to evolve from mere aggregate producers to “urban mining” excavators and waste management solution providers, thereby dominating the entire value chain from raw materials to waste recycling.

Empowerment through Technology and the Rise of “Smart Crushing Plants”

Future internal crushing plants will be highly automated and data-driven. By integrating IoT sensors, artificial intelligence, and machine learning algorithms, these plants will be capable of optimizing crushing parameters in real-time, predicting maintenance needs automatically, and achieving the best match between different quality raw materials and final product specifications. This will not only elevate efficiency to new heights but also enable the production of higher-spec, more profitable specialty aggregate products through precise control.

Core Hub of the Circular Economy

As global demands for sustainable building practices intensify, internal crushing plants will become central to cement and aggregate companies’ efforts to achieve “net-zero emissions” goals. They will work more closely with construction debris and demolition waste streams, transforming these materials into usable recycled aggregates for new concrete production. This approach significantly reduces dependence on natural resources while markedly cutting carbon emissions and landfill waste, making rock crusher plants true “green factories.”

Innovative Business Models and Data Monetization

Mastering the crushing phase means that companies will also possess valuable data regarding raw material characteristics, production efficiency, and quality control. This data could become a new asset, optimizing factory designs globally, providing clients with compelling product lifecycle analyses, and even offering precise accounting foundations for carbon trading.

In summary, the initiative to build in-house crushing plants is steering traditional cement and aggregate giants toward a future characterized by resilience, profitability, and sustainability. This is no longer an isolated operational decision; it is a cornerstone for companies transitioning to integrated, technology-driven, and eco-friendly solution providers. Those who lead in this domain will undoubtedly command significant authority in future market competition.