- Infrastructure Investment: The 2025 federal budget allocates MYR 50 billion (approximately USD 11 billion) for infrastructure projects, including railways, flood mitigation, and airport expansions.

- Green Technology Adoption: The integration of Building Information Modeling (BIM), renewable energy projects, and green building standards.

- Urbanization Demand: The urbanization rate is projected to reach 75% by 2030, fueling demand for housing and public infrastructure.

Challenges include labor shortages, rising material costs, and stringent environmental regulations. However, the adoption of Public-Private Partnership (PPP) models and digital transformation offers pathways for sustainable growth.

Industry Overview

Upon investigation, the development of Malaysia’s construction industry presents three core trends: 1. infrastructure-led growth, East and West Malaysia synchronously promote the construction of transportation networks, energy facilities and public projects; 2. the green building market expansion, the policy to regulate the treatment of construction waste, to promote the landing of the recycling economy; 3. the deepening of the digital transformation, BIM technology, 3D printing and other technologies to reduce the cost of on-site construction and optimize the construction process.

Malaysian Market Analysis

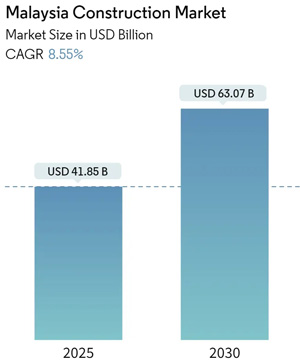

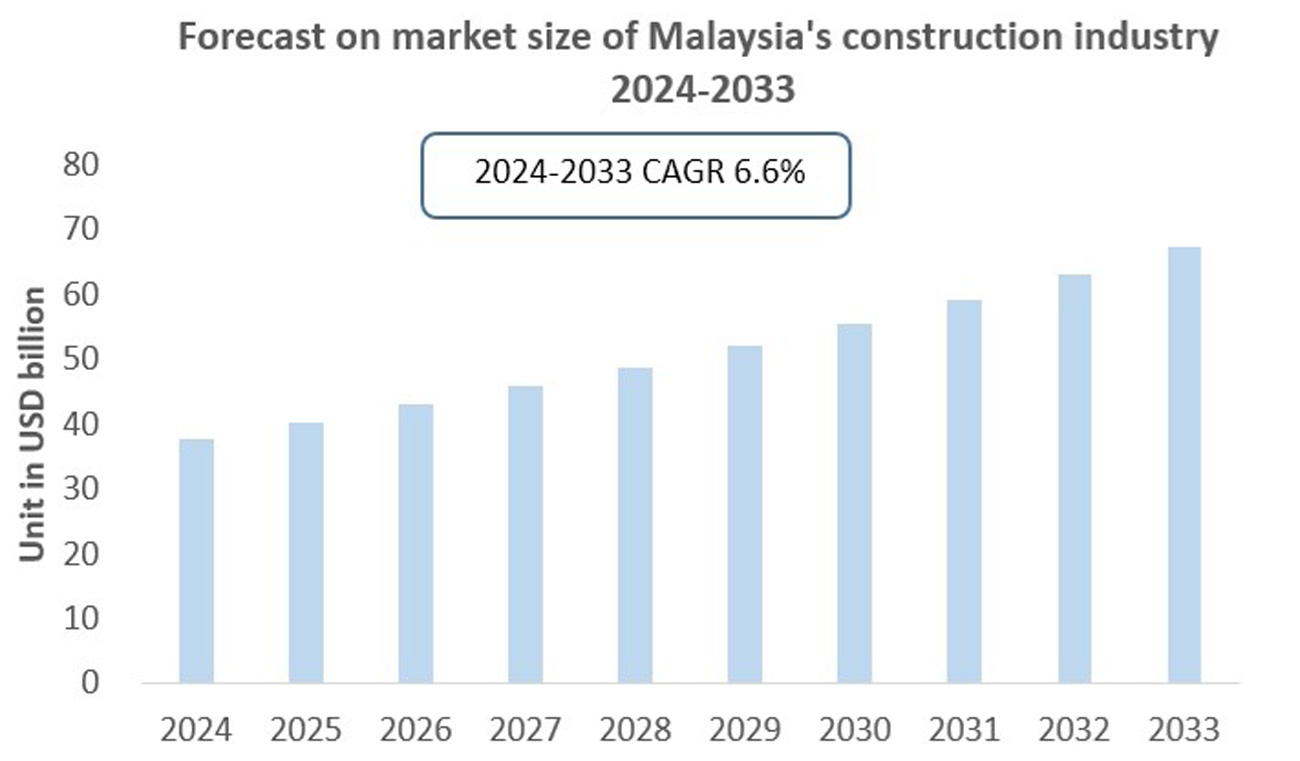

1. Market Size:

In 2024, the construction industry contributed approximately 5.6% to Malaysia’s GDP. With increased government investment, the sector is expected to maintain an annual growth rate of 6–7% over the next five years.

2. Development Trends:

- Infrastructure Dominance: The Malaysian Development Blueprint continues to drive large-scale transportation, energy, and public facility projects, especially in East and West Malaysia.

- Green Transformation: The green building market is anticipated to grow, with an emphasis on LEED certification and renewable energy projects.

- Digital Transformation: The application of BIM and automation technologies is set to enhance construction efficiency and project quality.

3. Regional Market Analysis:

- Peninsular Malaysia: Focused on commercial real estate and high-end residential developments in cities like Kuala Lumpur, Penang, and Johor.

- East Malaysia: Sabah and Sarawak are undergoing significant infrastructure development, including transportation, energy, and housing projects.

Technological Trends

1. Key Technologies:

- BIM: Provides digital solutions throughout the building lifecycle, improving efficiency and reducing errors.

- 3D Printing and Prefabrication: Reduces on-site construction time and labor costs, enhancing safety and efficiency.

- Smart Construction: The use of automation, robotics, and drones to improve site management and construction quality.

2. Environmental and Sustainability Technologies:

- Green Building Materials: Increased use of low-carbon concrete and recycled materials.

- Renewable Energy Integration: Incorporation of Building Integrated Photovoltaics (BIPV) and hydropower infrastructure.

- Solid Waste Management: The 672 Act mandates the regulation of construction waste, promoting a circular economy.

3. Technology Suppliers and R&D Trends:

- International Collaborations: Companies from China, Japan, and Europe are partnering with local firms in BIM and prefabricated construction.

- Local Innovations: Malaysian companies are developing green building materials and smart construction technologies tailored to local needs.

Competitive Landscape and Industry Chain Insights

Driven by global infrastructure demand and technological innovation, Malaysia’s construction industry presents a competitive pattern of “traditional giants dominate + emerging technology breakthrough”. The value distribution of the industry chain is also significantly differentiated, and the following is an in-depth analysis.

Competitive Entities

1. Leading Companies:

- YTL Corporation Berhad

- IJM Corporation Berhad

- Gamuda Berhad

- UEM Group Berhad

- Malaysian Resources Corporation Berhad

2. Emerging Enterprises:

New, technology-driven companies are gaining prominence in digital construction and green building sectors.

3. Collaborative Models:

- PPP 3.0: Joint ventures between government and private enterprises, such as the Sabah Hydropower Project.

- International Alliances: Malaysian and Chinese companies are sharing digital management experiences.

Industry Chain Value Distribution

1. Upstream: Material suppliers (e.g., cement, steel) are affected by global price fluctuations, with a trend towards local production.

2. Midstream: General contractors lead project integration, with high technological value-added capabilities.

3. Downstream: Real estate developers and government agencies collaborate on affordable housing projects, with profit margins around 8–12%.

Policies and Regulations

Industry-Related Policies and Regulations

12th Malaysia Plan (2021–2025): Emphasizes support for infrastructure construction and enhancement of urban and rural infrastructure quality.

Construction Industry Development Blueprint: Aims to improve the technological level and service quality of the construction industry.

Digital Transformation Policy: Encourages construction enterprises to adopt BIM and digital tools to enhance project management efficiency.

Environmental Regulations

672 Act: Regulates solid waste management, with penalties up to MYR 10,000 or imprisonment for violations.

National Energy Policy (2022–2040): Requires new projects to meet a 45% reduction in carbon intensity.

Industry Standards and Certifications

ISO 9001: Quality management systems.

ISO 14001: Environmental management systems.

MS 1525: Green building certification, mandatory energy-saving standards for public projects.

ISO 45001: Occupational health and safety management systems, with over 60% adoption on construction sites.

Industry Opportunities and Challenges

Opportunities

Infrastructure Dividend: The government’s infrastructure investment plan will bring numerous project opportunities, with MYR 50 billion allocated in the 2025 federal budget for railway, flood control, and airport expansion projects.

Technological Upgrades: The application of BIM and automated construction technologies will drive the industry towards smarter and more efficient development, reducing labor dependence and increasing profit margins (e.g., drone inspections saving 30% in costs).

Regional Integration: The Regional Comprehensive Economic Partnership (RCEP) promotes cross-border building material trade, reducing procurement costs.

Challenges

Labor Shortage: The construction industry faces a shortage of skilled workers, especially high-skilled talent. The gap for technical workers is 15%, with a reliance on foreign labor constituting 40% of the workforce.

Cost Pressure: Due to international supply chain instability, fluctuations in construction material prices may affect profit margins. Steel price volatility (12% year-on-year increase in 2024) compresses profit margins.

Environmental Compliance: Increasingly stringent environmental regulations impose higher requirements on construction enterprises. Illegal landfill remediation (e.g., 52-hectare polluted area in Selangor) increases enterprise costs.

Response Strategies

Skills Training: Collaboration between government and enterprises in vocational education (e.g., BIM certification courses), with construction enterprises strengthening cooperation with academic institutions.

Green Financing: Issuance of sustainable bonds to support renewable energy projects.

PPP Optimization: Introduction of risk-sharing mechanisms to attract private capital.

Malaysia’s construction industry will enter a phase of “high-quality growth”, and enterprises need to build a trinity strategy of “policy response, technological innovation and localization cooperation” with ESG management as the core. Chinese companies can rely on technology export and production capacity cooperation to capture the market, while local companies need to consolidate their advantages through M&A integration and digital transformation.

In the long run, green energy, smart city and regional connectivity projects will become the main battlegrounds for industry growth, promoting Malaysia’s transformation from an “infrastructure chaser” to a “regional innovation leader”.

Reference

Data Sources and References

- Department of Statistics Malaysia (DOSM)

- Construction Industry Development Blueprint (CIDB)

- Building Information Modeling Association (BIM Association)

Industry Terminology Glossary

- BIM (Building Information Modeling): A digital tool designed to represent all physical and functional information of a building through 3D models. It facilitates the creation and management of information for a built asset across its lifecycle, from planning and design to construction and operations.

- PPP 3.0 (Public-Private Partnership 3.0): The third phase of Malaysia’s public-private partnership model, emphasizing shared risk and reward mechanisms to stimulate economic growth and infrastructure development.

- LEED Certification (Leadership in Energy and Environmental Design): A globally recognized green building certification system developed by the U.S. Green Building Council (USGBC). It provides a framework for healthy, efficient, and cost-saving green buildings, focusing on areas such as energy use, lighting, water, and material use.