Under the dual drivers of sustained global economic development and energy structure transformation, the mining industry is undergoing unprecedented changes. The shift from traditional resource extraction models to digital and intelligent development has become a strategic imperative for mining companies worldwide. Over the next five years, the mining sector will witness a series of profound core trends that will not only reshape the industry landscape but also redefine how mineral resources are developed and how value is created. This article will conduct an in-depth analysis of the key development trends in the mining industry over the next five years from multiple dimensions such as technological innovation, sustainable development, and operational model transformation, providing forward-looking strategic references for global mining professionals.

1. Digital Transformation: Accelerating the Development of Smart Mines

Widespread Application of Automation and Robotics Technologies

-

Automation and robotics are transforming mining, showing how the industry is going digital. With better sensors, control systems, and AI, mining machines are moving from simple mechanization to full autonomy. This improves safety, efficiency, and productivity while cutting costs. These technologies are used not only in open-pit haul trucks but also in dangerous underground tasks like drilling, blasting, and loading. Robotics are especially useful in deep mines, extreme conditions, or toxic areas where people cannot safely work.

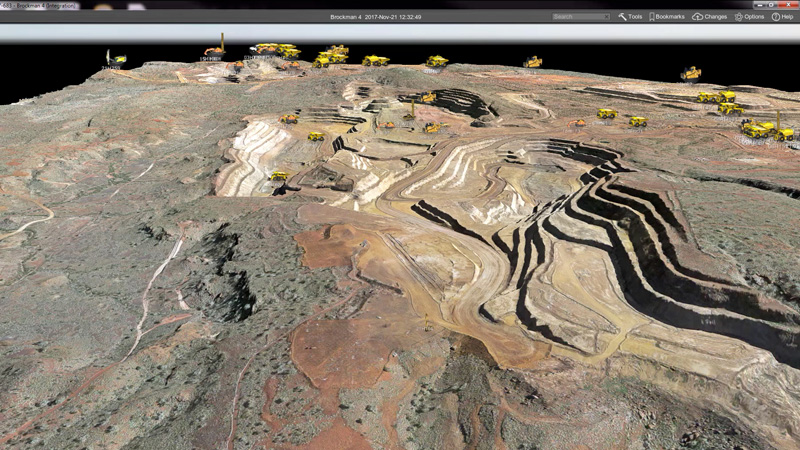

- A case in point is Rio Tinto’s “Mine of the Future” project in Australia, where its Pilbara-based operations have implemented a fully automated haul truck system. Leveraging advanced GPS and sensor technologies, these driverless trucks are capable of operating 24/7 in extreme environments, significantly improving production efficiency and reducing labor costs.

- Similarly, Canadian gold producer Goldcorp (now part of Newmont) has deployed automated drilling and blasting robots at its Pueblo Viejo mine in the Dominican Republic. These systems have not only enhanced operational precision but have also removed workers from hazardous environments.

It is projected that by 2028, over 60% of large-scale open-pit mines in major mining nations will achieve full automation in their haulage operations. This trend is expected to deepen further, expanding beyond transportation to encompass various segments across the entire mining value chain.

The Popularity of Digital Twins and Real-time Monitoring Systems

- Chile’s state-owned Codelco provides a representative example of digital twin implementation at its Chuquicamata underground mine. By creating a comprehensive digital mapping of the mine, the project enables real-time monitoring of orebody changes, equipment status, and production processes, improving decision-making efficiency by over 40%.

- The extensive deployment of IoT sensors enables continuous real-time data collection. At BHP’s iron ore operations in Australia, over 100,000 sensors monitor parameters ranging from ore grade to equipment health, with big data analytics used to optimize production decisions.

Digital twin technology is an advanced step in mining digitalization, creating a virtual copy of the mine for full life-cycle management. By combining IoT data, 3D geological models, equipment conditions, and production records, it provides a real-time digital view of operations. This allows mining companies to simulate scenarios, optimize plans, predict equipment issues, and improve efficiency. Real-time monitoring with dense sensor networks collects key data like ore grade, equipment status, environmental conditions, and worker locations.

Digital twins also support remote operations. Mining companies can establish control centers away from the site, using the digital twin interface to monitor and operate equipment in real time. This enhances safety and allows top mining experts worldwide to provide technical support to distributed sites. With the widespread adoption of 5G and high-speed communications, the integration of digital twins with real-time monitoring will become even tighter, delivering higher operational efficiency and safety.

By 2027, the world’s top 20 mining companies are expected to deploy full life-cycle real-time monitoring systems, with digital twin technology becoming standard for large-scale mines.

2. Artificial Intelligence and Data Analysis: A Leap Forward in Intelligent Decision-Making

AI-Driven Resource Exploration and Reserve Estimation

Artificial intelligence is transforming mineral exploration and assessment by overcoming the limits of traditional methods—high costs, low success rates, and complex geology. With advanced machine learning and deep learning, AI analyzes huge geological, geophysical, and geochemical datasets to find patterns humans might miss, greatly improving efficiency and accuracy.

In reserve estimation, AI combines drilling data, production records, and real-time monitoring to deliver more precise resource estimates than traditional models, supporting better mine planning, investment, and long-term strategy.

A leading example is Freeport-McMoRan in the United States. The company applies machine learning algorithms to analyze geological data and satellite imagery, successfully discovering new copper deposits in Arizona while reducing exploration costs by 60%.

Similarly, Canadian exploration technology firm KoBold Metals has developed AI models capable of predicting deposit locations, achieving accuracy levels exceeding those of conventional geological exploration methods.

Production Optimization and Predictive Maintenance

The use of artificial intelligence in optimizing production processes is growing quickly, especially in mining companies seeking greater efficiency, lower costs, and more sustainable practices. AI algorithms can analyze large amounts of real-time data from mining operations, including ore characteristics, crushing plant equipment conditions, environmental factors, and production workflows. This allows for dynamic adjustments to improve the entire production chain’s efficiency.

In predictive maintenance, AI examines sensor data like vibration, temperature, and pressure to foresee potential equipment failures. This approach changes maintenance from traditional reactive or scheduled methods to condition-based predictive maintenance, which reduces unplanned downtime, extends equipment life, and lowers maintenance costs.

For example, Vale in Brazil has deployed AI optimization systems at its iron ore pellet plants, achieving a 12% reduction in energy consumption and an 8% increase in output through real-time process adjustments. Similarly, Norwegian titanomagnetite producer Elkem uses AI algorithms to optimize smelting processes, improving product quality consistency.

In predictive maintenance, U.S.-based Komatsu collaborates with AI startups to develop maintenance systems that analyze vibration and temperature data, predicting equipment failures in advance and reducing unplanned downtime by over 50%.

By 2026, major global mining equipment manufacturers are expected to widely offer AI-based predictive maintenance solutions, either as Software-as-a-Service (SaaS) or integrated into equipment control systems, establishing a new standard of “intelligent mining equipment.” Mining companies will no longer rely on fixed maintenance schedules or reactively address equipment failures, but instead make optimal maintenance decisions based on real-time data, maximizing asset utilization.

3. Sustainable Development: Global Consensus on Green Mining

Energy Transition under Carbon Neutrality Goals

The global mining industry is undergoing a significant transformation toward decarbonization. Leading companies are setting ambitious carbon neutrality targets and taking concrete actions in response to pressure from investors, governments, and communities about climate change, as well as the decreasing costs of low-carbon technologies. Mining firms see carbon neutrality as both an environmental responsibility and a strategic move for long-term competitiveness. The shift towards electric equipment and renewable energy is a key pathway, helping to reduce carbon emissions, optimize costs, and improve working conditions.

Vale, the world’s largest iron ore producer, has committed to achieving Scope 1 and Scope 2 carbon neutrality by 2050 and has invested $2.5 billion in electric equipment and renewable energy projects.

Anglo-Australian mining giant BHP plans to provide 1 GW of renewable energy capacity for its Australian operations by 2025.

At the equipment level, battery-powered mining machines are gradually replacing traditional diesel units. Swedish miner Boliden is testing fully electric haul trucks at its Aitik copper mine, achieving a 70% reduction in energy costs with near-zero noise and emissions. Chinese equipment manufacturers such as XCMG have launched a series of electric mining trucks, and by 2028, electric haul trucks are expected to account for over 30% of new global sales.

Circular Economy and Tailings Management Innovation

The mining industry is shifting from a “linear extraction” model to a circular economy approach, reflected in innovative practices in tailings management and water resource utilization. Tailings—traditionally considered waste as large volumes of solid residues—are increasingly recognized as potential resource reservoirs, while water management has become a critical challenge for sustainable mining in arid and semi-arid regions. Leading companies are turning these challenges into competitive advantages through technological innovation and strict management.

Tailings Management Cases

In tailings management, Australia’s CSIRO has developed tailings reprocessing technologies that recover residual valuable minerals from historical tailings while reducing environmental risks.

In Canada, the Toronto Stock Exchange requires listed companies to disclose Tailings Storage Facility (TSF) risk management, driving the industry toward safer tailings practices.

Water Resource Management Case

In water resource management, top mining companies have set benchmarks. According to the Chilean Copper Commission, leading firms achieve over 90% water recycling rates, with some operations reaching “zero freshwater” extraction. Israeli mining company IPC employs advanced membrane filtration and seawater desalination at its desert operations, achieving a 98% water recycling rate.

4. Automation and Remote Operations: Reshaping Mining Work Models

The Rise of Centralized Remote Control Centers

The mining operating model is quietly but significantly changing—from on-site management to centralized remote control. Digital technologies now allow global coordination of mining assets, improving efficiency, reducing safety risks, and enabling better use of technical expertise. Leading companies are setting up remote operations centers in key hubs, using high-speed networks and advanced control systems to monitor and manage mining sites in real time, creating a new “virtual mine” model.

Fortescue Metals Group (FMG) in Australia exemplifies this trend with its global operations center located at its Perth headquarters. Through advanced digital platforms, FMG remotely manages autonomous haul truck fleets and automated stone crushing plant equipment for mining operating across vast regions of Western Australia. Operators can monitor and direct field operations in real time via live video feeds and sensor data, all from the safety of a location hundreds of kilometers away.

Similarly, Anglo American in South Africa has established its high-tech “FutureSmart Mining” control room, which monitors operations across three continents, enabling managers to coordinate global mining assets and make optimized, centralized decisions regardless of geography.

This centralized model delivers significant benefits:

- Enhanced safety: Moving operators from hazardous mine sites into secure control centers dramatically reduces human exposure to risk.

- Cost efficiency: Standardized processes and centralized expert teams lower operational costs.

- Knowledge sharing: Best practices developed in one region can be immediately deployed across other operations, facilitating rapid global adoption of innovations.

Industry forecasts indicate that by 2027, the world’s top 50 mining companies will have implemented some form of remote operations capability. This transformation is not only altering the geographical footprint of mining operations but also redefining how mining work is performed and how value is created in the industry.

Applications of Virtual Reality (VR) and Augmented Reality (AR)

Mining training and equipment maintenance are being transformed by Virtual Reality (VR) and Augmented Reality (AR), replacing traditional training and paper manuals. These technologies provide safer, more immersive, and efficient learning and work environments. They simulate hazardous conditions and offer real-time guidance, improving training results and maintenance efficiency while lowering costs and operational risks.

Teck Resources in Canada has implemented VR-based training to simulate high-risk scenarios for its workforce, resulting in a 45% reduction in incident rates.

Thyssenkrupp in Germany has developed AR-assisted maintenance systems for mining equipment, where technicians use smart glasses to receive real-time procedural guidance, improving maintenance efficiency by 30%.

Looking ahead, the Mining Education Australia (MEA) initiative has developed a virtual mine training platform that offers students and mining employees a fully immersive digital environment for learning complex mining skills and procedures. This solution is particularly valuable for operations in remote locations, eliminating geographic and time barriers associated with traditional training programs.

5. Reshaping the Mining Supply Chain and Value Chain: Digitalization and Transparency

Blockchain Applications in Mining Supply Chains

As sustainability and responsible sourcing requirements tighten globally, blockchain technology is transforming how mineral resources are tracked and traded. With its immutable and fully traceable nature, blockchain plays a critical role in conflict mineral compliance and critical raw material provenance. By creating a shared, tamper-proof transaction ledger, mining companies and their customers can verify the origin, transportation routes, and transaction history of minerals in real time, ensuring supply chain integrity and sustainability.

- Glencore has partnered with IBM to build a blockchain platform to trace the end-to-end flow of key minerals such as cobalt.

- Smart contracts are streamlining trading processes. Fortescue Metals Group (FMG) in Australia piloted blockchain-based smart contracts to automatically execute iron ore sales agreements, reducing settlement time from several weeks to just a few hours.

By 2029, over 50% of global trade in strategic minerals is expected to involve some form of blockchain-enabled solution.

Data-Driven Customer Relationship Management

The relationship between mining companies and downstream customers is shifting from simple transactional sales to strategic partnerships based on data sharing and collaborative optimization. Leveraging advanced analytics, mining companies now gain deep insight into customer needs and deliver value-added services beyond raw material supply. By collecting and analyzing customer operational data, process parameters, and market trends, miners can offer tailored solutions that help customers optimize production, reduce costs, and improve product quality—reshaping the entire mining value chain.

- Vale has developed a data platform that provides customized ore blending recommendations to steelmakers, improving blast furnace efficiency.

- Trafigura uses AI to analyze global metal consumption trends, enabling smarter inventory and logistics decisions.

This data-driven business model is redefining miners as strategic partners in customers’ value creation rather than mere raw material suppliers. By 2028, leading mining companies are expected to establish dedicated digital customer service divisions as standard practice.

Conclusion: Seizing Industry Trends to Secure the Future

Over the next five years, the mining industry will undergo a profound transformation driven by digitalization, intelligent systems, and sustainability imperatives. From the full-scale deployment of smart mines to low-carbon operational transitions, from AI-enabled decision optimization to blockchain-powered supply chain transparency, these trends will not only redefine the sector’s technological foundations but also reshape how mining companies build competitive advantage and create long-term value.

Global mining companies must respond proactively by developing clear strategic roadmaps, investing in critical digital technologies, and balancing economic performance with environmental stewardship. Those who anticipate and act decisively on these megatrends will emerge as industry leaders, achieving sustainable growth in an increasingly competitive landscape.

The era of Mining 4.0 has arrived—not merely as a technological upgrade, but as a fundamental shift in industry mindset and business models. Looking ahead, only mining enterprises that embrace innovation, foster collaboration, and commit firmly to sustainable development will capture first-mover advantage, generating superior economic returns and broader social value in this new age of mining.